Here are 5 such stocks…

#1 Varun Beverages

First on our list is Varun Beverages.

Varun Beverages is PepsiCo's largest bottler outside the US.

It's responsible for manufacturing, bottling and distributing soft drinks across India and international markets. It operates across carbonated soft drinks (CSD), juices, and packaged water. It serves top brands like Pepsi, Mountain Dew, Slice, and Aquafina.

FY25 was another strong year. Revenue increased to Rs 200 bn, a 25% YoY growth. The operating margin remained stable at a solid 24%.

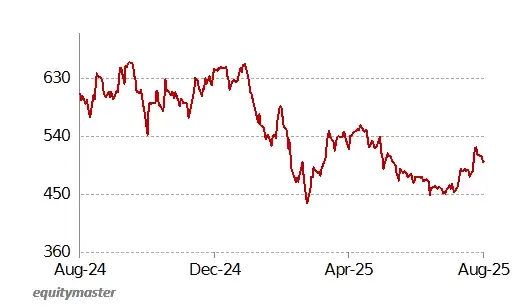

Varun Beverages Share Price - 1 Year

Source: NSE

Source: NSEDomestic volumes held strong, helped by deeper rural penetration, expanded retail footprint, and new packs targeting affordability. International operations also showed resilience.

Capacity additions, automation and backwards integration are driving operating leverage.

Varun Beverages is sharpening its focus on innovation and premiumisation. The company is pushing low-sugar, non-carbonated and functional beverages responding to shifting consumer preferences.

It's also expanding distribution into tier-2 and tier-3 towns to drive incremental growth.

The stock trades at a PE ratio of 60, a small discount to its 5-year median PE of 66 times.

The company has strong cash flows, a return on equity of over 23% and a dividend payout of 13%.

#2 Power Finance Corporation

Next on the list is Power Finance Corporation.

Power Finance Corporation (PFC) is India's largest NBFC by asset base and a key financier for the country's power sector.

The financier provides loans across the power value chain - from generation and transmission to distribution - and is now expanding into emerging areas like renewables and battery storage.

FY25 was a record year. Consolidated net profit rose 15% to Rs 305 bn, while the standalone profit hit an all-time high, up 21% from FY24.

This growth was driven by a 24% rise in net interest income, strong resolution recoveries and continued control on asset quality. PFC declared a total dividend of Rs 15.8 per share in FY25.

Loan assets crossed Rs 11 tn, a 12.8% YoY growth. The renewable loan book grew 35% to Rs 8,103 bn, making PFC the largest green energy financier in India.

Meanwhile, the company's yield stood at 10.02% and net interest margin at 3.64%, both within guided ranges.

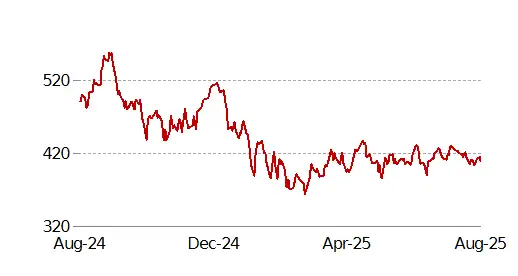

PFC Share Price - 1 Year

Source: NSE

Source: NSEAsset quality saw notable improvement. Gross NPA dropped to 1.94%, while net NPA fell to 0.39%, the lowest in 7 years.

PFC successfully resolved the KSK Mahanadi project with full principal recovery and partial interest gains, while maintaining a strong 80% provisioning on its stage 3 assets.

Looking ahead, PFC is targeting 10-11% loan growth in FY26. While traditional thermal financing continues, opportunities in hybrid, renewables, battery storage, and nuclear power are opening up.

The company will be active in funding discoms through the RDSS scheme and bill-payment facilities.

With a strong net worth, a capital adequacy ratio of 22.08%, good return on equity and consistent dividend payouts, PFC remains well-capitalised and operationally sound.

#3 AWL Agri

Third on our list is AWL Agri.

AWL Agri is a major player in India's edible oils and branded food products space.

The company, best known for its flagship Fortune brand, operates across three segments. This includes edible oils, packaged foods and industry essentials.

It benefits from strong distribution reach, access to global sourcing and a growing portfolio.

FY25 was a reset year. Consolidated revenue rose 24% after last year's sharp decline, helped by a recovery in food and industry segments, even as edible oils remained under pressure.

Operating profit more than doubled and margin improved to 4%. The net profit tripled after a muted FY24.

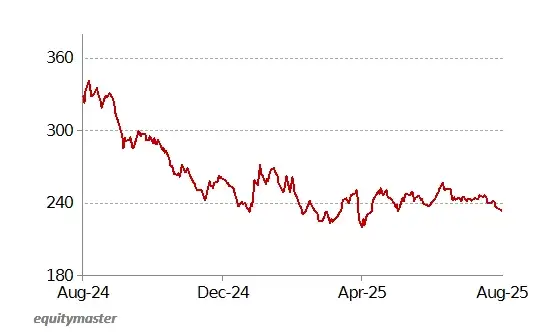

AWL Agri Share Price - 1 Year

Source: NSE

Source: NSEAWL Agri is shifting from a commodity-heavy portfolio to higher-margin branded food products.

The packaged foods segment, which includes rice, wheat flour, and ready-to-cook products, posted strong growth in FY25 and now contributes a meaningful share of total sales. Industry essentials like oleochemicals also grew in double digits.

The company is expanding its refinery and packaging capacities. New product launches and rural market expansion are expected to aid volume growth, particularly in foods and essentials.

A proposed demerger of the food business could unlock value and offer investors focused exposure.

The stock trades at a PE ratio of 28, a big discount to its historical average.

AWL is debt-free and capital-efficient, with strong backing from its parent. If execution stays on track, the company is well-positioned to tap into India's evolving consumption story.

#4 ONGC

Fourth on our list is ONGC.

ONGC is India's largest oil and gas producer. The company has a presence that spans exploration, refining, petrochemicals, and renewables.

FY25 was a mixed year. Consolidated net profit dropped 31% to Rs 383 bn, mainly due to weaker performance from downstream businesses like HPCL, MRPL and OPaL.

But the topline stayed steady, with consolidated revenue moving up 1.5% to Rs 6.63 trillion (tn).

Even in a down year, ONGC declared a dividend of Rs 12.25 per share, the highest in its history and a yield of over 5% at current prices.

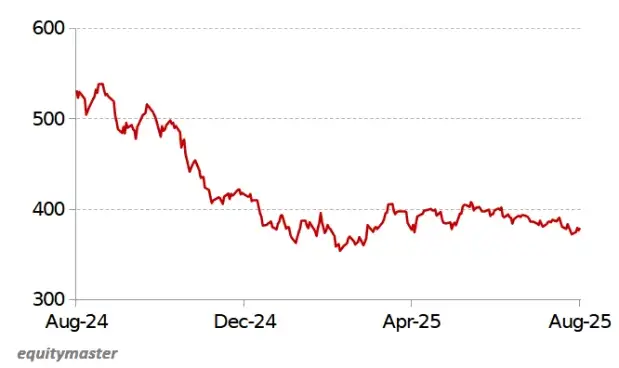

ONGC Share Price - 1 Year

Source: NSE

Source: NSECrude oil output rose 0.9% in FY25 and gas volumes are expected to pick up meaningfully over the next year.

Output from the KG-DWN-98/2 field is already at 75% of peak oil production and gas output from the same is set to rise from 2.8 to 10 mmscmd by FY26.

Two other offshore projects could add another 9 mmscmd, lifting the share of higher-priced gas to 40% by the end of FY26.

Beyond fossil fuels, ONGC is building out its clean energy portfolio. It scaled up rapidly from 192 MW to 2.5 GW in FY25 via acquisitions like Ayana and PTC and has a target of 10 GW by 2030.

In petrochemicals, OPaL is showing signs of a turnaround. With ONGC now owning 95% and after exiting the SEZ and securing cheaper gas input, margins are expected to improve.

Despite elevated capex and sectoral headwinds, ONGC remains financially strong. It trades at just 0.86, a price-to-book close to its long-term average.

#5 Coal India

Last on our list is Coal India.

Coal India is the world's largest coal producer. It plays a key role in powering India's energy needs. The company generated Rs 1.43 tn in consolidated revenue and paid out a hefty dividend, making it one of the most shareholder-friendly PSUs in the country.

The stock trades at a price to book (PB) of just under 2.4, close to its long-term average and well below the peak of 5.2 seen during the PSU re-rating cycle. Even as concerns around coal's long-term future grow, the business continues to throw up consistent cash flows.

Coal India Share Price - 1 Year

Source: NSE

Source: NSEIn the past financial year, revenue was flat, while EBITDA stood at Rs 470 billion (bn), marginally lower than the previous year.

Net profit declined 5.7% to Rs 330 bn, mainly due to a higher tax outgo and normalisation in other income. Still, margins held firm at around 33%, supported by cost control and steady performance in the linkage segment.

The company launched three new MDO mines and is targeting 1 bn tonnes of annual production by FY26, up from 781 m tonnes in FY25. A Rs 165 bn capex plan is underway for mine development, washeries, and evacuation infrastructure.

Coal India has set up a subsidiary to scale its solar business and signed a 500 MW project MoU with UPRVUNL. It's also exploring critical minerals in collaboration with Hindustan Copper and has secured graphite and vanadium blocks in Chhattisgarh.

All of this is being done with minimal debt and robust cash flows. Return on equity stood at 39%.

👉When indices rally for years and valuations stay elevated, it's tempting to believe that everything worth owning has already been bought.

But history shows that even in bull markets, opportunities exist for those willing to look beyond the obvious. Value investing works, but it demands patience and a willingness to go against the crowd.

It also requires a clear-eyed view of risks. Not every low-valuation stock is a bargain and not every high-growth story justifies a premium.

In this kind of market, being selective matters more than ever. Focus on quality. Watch out for a margin of safety. And most importantly, don't confuse price action with business fundamentals.

Investors should carefully evaluate these companies' fundamentals, corporate governance, and valuations as key factors when conducting due diligence before making investment decisions.

Happy investing.👈

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here

source: Financial Express

No comments:

Post a Comment