G.R. Infraprojects has emerged as lowest bidder for a renewable energy project in Madhya Pradesh. The project is to set up transmission system for renewable energy projects which is worth Rs 367 crore.

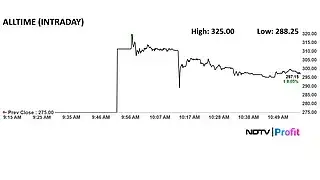

All Time Plastics Ltd. made a notable debut on the stock market on Thursday as shares listed at a premium of 14% over the IPO price. The scrip opened at Rs 311.3 apiece on the NSE and Rs 314.3 on the BSE. The issue price was Rs 275.

Engineers India Ltd. has signed memorandum of understanding with the Nuclear Power Corp for small modular reactor to provide engineering services for development of Bharat Modular Reactor, the company said in the exchange filing.

Suzlon Energy has clarified that there is no event that required disclosure at this juncture. The clarification followed report of Rs 6,000-crore deal with Tata Power for 700 megawatt project in Andhra Pradesh

BSE has launched the BSE India Defence Index to gauge the performance defence companies' stocks.

The constituents of the index will be derived from the BSE 1000 index.

BSE has launched the index amid sustained gains in the defence stocks in past few months.

Source: Media Press Release

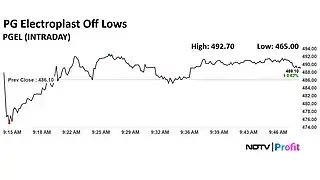

PG Electroplast Ltd. share price fell to the lowest level in one year following weak performance in the first quarter. The stock has slumped 40% in August so far.

JSW Cement shares listed at 4% premium over the IPO price. The scrip opened at Rs 153.5 apiece on the NSE and Rs 153 on the BSE.

The issue price was Rs 147.

Shares of Muthoot Finance Ltd., was up over 10% and locked in a circuit on the back of the notable zoom in the profit that company posted in the first quarter.

Muthoot Finance Ltd. reported a robust 73% rise in consolidated net profit in the first quarter of the current financial year. The company reported a bottom line of Rs 2,016 crore against Rs 1,164 crore in the year-ago period. The Net interest income was up 43% to Rs 3,933 crore versus Rs 2,754 crore. While the Impairment was down 11.7% to Rs 331 crore versus Rs 375 crore.

Although local markets have seen a rebound this week, the upside has been capped amid concerns of Trump's tariff hikes on India. Technically, Nifty also continues to trade way below its 21-day moving average (24,803) and 50- day moving average 25,023. While Indian markets will be closed on Friday on account of Independence Day, investors will be watchful of the Trump-Putin summit to take place in Alaska tomorrow," said Prashanth Tapse, a senior vice president research), Mehta Equities.

The NSE Nifty 50 and BSE Sensex opened higher as Infosys Ltd. and Bharti Airtel Ltd. share prices led. The indices were trading 0.02% and 0.01% higher, respectively as of 9:22 a.m.

The yield on the 10-year bond opened flat at 6.47%

Source: Bloomberg

Rupee opened 3 paise weaker at 87.47 a dollar

It closed at 87.44 a dollar on Wednesday.

Source: Cogencis

Gold prices advanced for three days in a row as the hope for rate cuts from the US Federal Reserve increased after expected inflation rise.

Bloomberg spot gold was trading 0.12% higher at $3,359.81 an ounce.

Oil prices consolidated in Asia trade session after it hit a two-month low in previous session. The oil prices declined as the International Energy Agency warned of a over supply next year.

The brent crude was trading 0.55% higher at $65.98 a barrel as of 8:00 a.m.

Bitcoin hit a record high Wednesday, moving in lockstep with a rally in US equities as investors pushed deeper into risk-taking territory across world markets. The crypto currency rose to $1,24,514 today, marking a fresh record high according to Bloomberg data. The previous high of $123,205.12 was hit on on July 14.

Maintain Buy and cut the target price to Rs 110 from Rs 120

Margin Miss in first quarter

In a tough macro, SAMIL is expanding its non-auto business well, especially in electronics

It expects margins to improve sequentially as cost optimization efforts in Europe bear fruit

Start-up costs at new plants to fade with production ramp-up

The brokerage has cut FY26-28E EPS by 10-15%

Maintain Buy and hike a target price to Rs 2,950 from Rs 2,660

First quarter Solid Quarter; Strong AUM Growth; NPA Recoveries Boost Profit

Gold price tailwind, headroom to lift LTV should support healthy loan growth

NIM should expand due to easing rates

With limited loan losses, it stays a defensive play amid rising broader stress

Expect 23% profit CAGR, ROE of 21%+ over FY26-28

Markets in Asia-Pacific region were trading on a mixed note Thursday as traders await fresh set of data from the US to get more cues on rate cut by the US Federal Reserve.

As of 7:18 a.m., the Nikkei 225 was trading 1.29% down as the Japanese yen gained against the US dollar. US Treasury Secretary Scott Bessent said that the Japan's central bank is falling behind the curve to maintain inflation. The Bank of Japan may start to raise rates.

US stock futures were trading lower as market participants brace themselves for more economic data from the US. On Thursday, there's jobless claims data, and retail sales data on is due on Friday.

The Dow Jones Industrial Average and S&P 500 futures were trading 0.04% and 0.08% lower, respectively as of 7:10 a.m. The Nasdaq 100 futures was trading 0.08% down.

On Wednesday, the Nasdaq 100 and S&P 500 indices hit fresh highs on hope of rate cuts in next month.

Good morning! welcome to NDTV Profit's blog for real-time stock market coverage.

The GIFT Nifty was trading 0.10% or 24 points lower at 24,686 as of 6:38 a.m. The implied open for the benchmark NSE Nifty 50 is expected to 25 points lower than Wednesday's close.

HDFC Bank Ltd., Infosys Ltd., Muthoot Finance Ltd., Rail Vikas Nigam Ltd., and Wipro India Ltd. share prices are in focus.

The benchmark equity indices closed the day in the green, snapping their two-day losing streak on Wednesday. Shares of Apollo Hospitals, Hindalco contributed positively to the index.

The NSE Nifty 50 ended 131.9 points or 0.54% higher at 24,614.3 and the BSE Sensex ended 304.3 points or 0.38% up at 80,539.9.

No comments:

Post a Comment