AWL Agri is a major player in India's edible oils and branded food products space.

The company, best known for its flagship Fortune brand, operates across three segments. This includes edible oils, packaged foods and industry essentials.

It benefits from strong distribution reach, access to global sourcing and a growing portfolio.

FY25 was a reset year. Consolidated revenue rose 24% after last year's sharp decline, helped by a recovery in food and industry segments, even as edible oils remained under pressure.

Operating profit more than doubled and margin improved to 4%. The net profit tripled after a muted FY24.

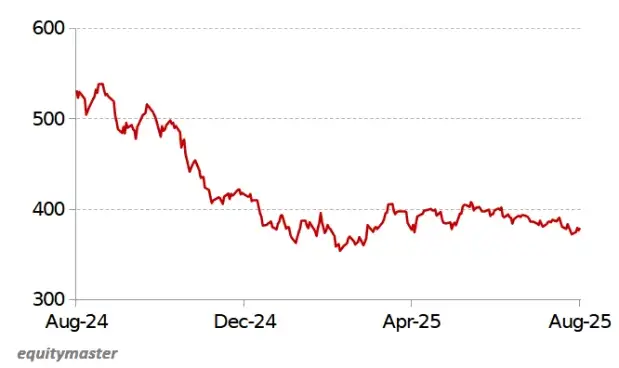

AWL Agri Share Price - 1 Year

Source: NSE

Source: NSEAWL Agri is shifting from a commodity-heavy portfolio to higher-margin branded food products.

The packaged foods segment, which includes rice, wheat flour, and ready-to-cook products, posted strong growth in FY25 and now contributes a meaningful share of total sales. Industry essentials like oleochemicals also grew in double digits.

The company is expanding its refinery and packaging capacities. New product launches and rural market expansion are expected to aid volume growth, particularly in foods and essentials.

A proposed demerger of the food business could unlock value and offer investors focused exposure.

The stock trades at a PE ratio of 28, a big discount to its historical average.

AWL is debt-free and capital-efficient, with strong backing from its parent. If execution stays on track, the company is well-positioned to tap into India's evolving consumption story

Coal India is the world's largest coal producer. It plays a key role in powering India's energy needs. The company generated Rs 1.43 tn in consolidated revenue and paid out a hefty dividend, making it one of the most shareholder-friendly PSUs in the country.

The stock trades at a price to book (PB) of just under 2.4, close to its long-term average and well below the peak of 5.2 seen during the PSU re-rating cycle. Even as concerns around coal's long-term future grow, the business continues to throw up consistent cash flows.

Coal India Share Price - 1 Year

Source: NSE

Source: NSEIn the past financial year, revenue was flat, while EBITDA stood at Rs 470 billion (bn), marginally lower than the previous year.

Net profit declined 5.7% to Rs 330 bn, mainly due to a higher tax outgo and normalisation in other income. Still, margins held firm at around 33%, supported by cost control and steady performance in the linkage segment.

The company launched three new MDO mines and is targeting 1 bn tonnes of annual production by FY26, up from 781 m tonnes in FY25. A Rs 165 bn capex plan is underway for mine development, washeries, and evacuation infrastructure.

Coal India has set up a subsidiary to scale its solar business and signed a 500 MW project MoU with UPRVUNL. It's also exploring critical minerals in collaboration with Hindustan Copper and has secured graphite and vanadium blocks in Chhattisgarh.

All of this is being done with minimal debt and robust cash flows. Return on equity stood at 39%.

No comments:

Post a Comment