NIFTY50

- January Futures: 22,977 (▲0.6%)

- Open interest: 3,58,780 (▼24.0%)

The NIFTY 50 index rebounded on January 28, recovering a portion of the previous day's losses to close 0.6% higher. However, the index faced resistance at the critical 23,000 mark, as investors remained cautious ahead of the Budget announcement.

As per the daily chart, the index has immediate resistance around the 23,350 zone. Meanwhile, the immediate support for the index is between the 22,750 and 22,800 zones. A breach below this zone might intensify selling pressure, potentially dragging the index down to 22,600.

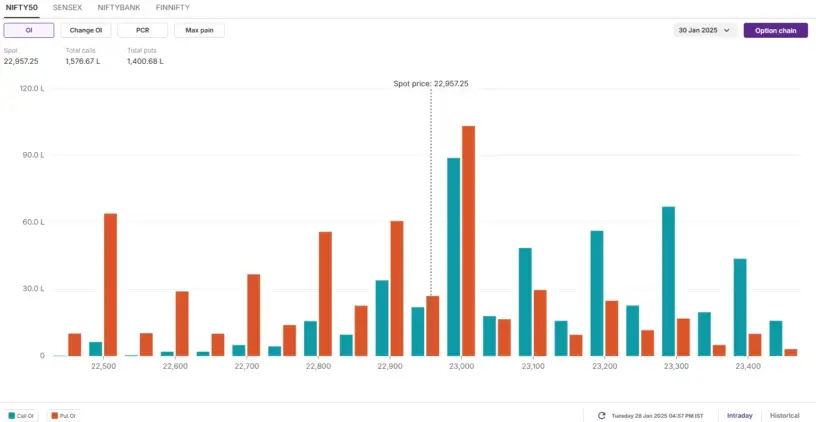

Meanwhile, the open interest data for the 30 January expiry saw significant call and put build-up at 23,000 strike, suggesting range-bound activity around this zone. On the other hand, minor call and put open interest build-up was also seen at 23,300 and 22,500 strikes.

Levels For The Nifty50 (22,957)

Resistance based on pivot points: 23,091, 23,157, and 23,264

Support based on pivot points: 22,877, 22,811, and 22,704

The Nifty 50 formed a Doji candlestick pattern on the daily charts with above-average volumes, indicating indecision among bulls and bears, though there was a higher high-higher low formation. The index still traded below all key moving averages (10, 20, 50, 100, and 200-day EMAs), and the momentum indicators remained in negative territory.

NIFTY BANK

- January Futures: 90,035 (▲1.6%)

- Open interest: 3,58,780 (▼28.0%)

The BANK NIFTY index started Tuesday's session on a positive note as India's central bank, RBI announced measures to inject liquidity into the banking system. This includes bond purchases, including bond purchases and dollar/rupee swaps worth ₹1.5 lakh crore.

Meanwhile, the technical structure of the banking index as per the hourly chart remains range-bound between 49,600 and 48,000. The index is consolidating within this range for the past eleven trading sessions. For the upcoming sessions, traders monitor these levels as a close above these levels will provide further directional clues.

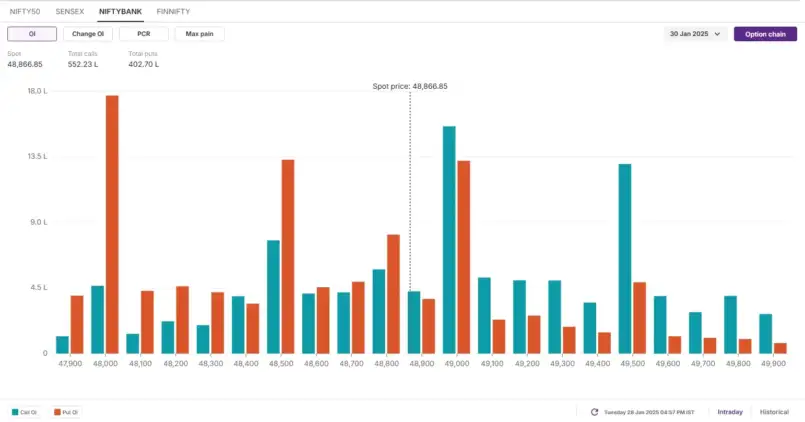

The open interest data for the 30 January expiry saw a significant put base at 48,000 strike, suggesting support for the index around this level. On the flip side, the call base was seen at 49,500, indicating resistance around this zone. Additionally, the index also witnessed significant accumulation of call and put base at 49,000 strike, signalling range-bound activity.

Levels For The NiftyBank (48,867)

Resistance based on pivot points: 49,159, 49,348, and 49,652

Support based on pivot points: 48,550, 48,361, and 48,056

Resistance based on Fibonacci retracement: 49,409, 50,381

Support based on Fibonacci retracement: 47,869, 46,078

The NiftyBank saw a gap-up opening and formed a bullish candlestick pattern with a long upper wick and small lower shadow on the daily timeframe, indicating selling pressure at higher levels. The index moved closer to the midline of the Bollinger Bands intraday and closed 1.67 percent higher with significant volumes for another session. Overall, sentiment still remains bearish with negativity in momentum indicators, and the index traded below the 20, 50, 100, and 200-day EMAs.

FII-DII activity

Foreign Institutional Investors (FIIs) extended their selling spree for the 18th consecutive session, offloading equities worth ₹4,920 crore. Meanwhile, Domestic Institutional Investors (DIIs) countered the pressure, stepping up with purchases totaling ₹6,814 crore, offering some stability to the market.

source: Upstox & Network18

No comments:

Post a Comment