- January Futures: 23,781 (▼0.0%)

- Open interest: 5,17,103 (▲2.1%)

- Max call OI: 80,000

- Max put OI: 76,000

- (Expiry: 14 Jan)

NIFTY50

After an initial dip, the NIFTY50 index staged a sharp recovery of nearly 200 points from the day's low and ended the Wednesday's session on a flat note. The index formed a bullish hammer pattern on the daily chart, which is considered as a reversal pattern.

The hammer pattern typically forms at the end of a downtrend. It features a small real body near the top of the candle with a long lower shadow, indicating strong buying pressure after lower levels. However, the pattern gets confirmed if the close of the subsequent candle is above the high of the reversal pattern.

On the daily chart, despite breaking below the inside candle pattern formed on January 8, the index staged a strong rebound from the key support zone of 23,400-23,500. Furthermore, it has consistently maintained the December 20 low of 23,537 on a closing basis. On the upside, immediate resistance is seen near the 24,200 zone.

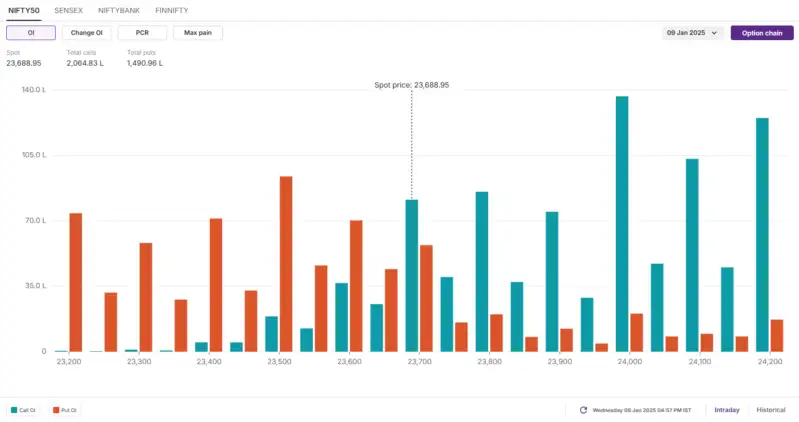

The open interest data for the 9 January expiry sustained the call bases at 24,000 and 24,100 strikes, pointing at resistance for the index around these levels. On the flip side, the put additions was seen at 23,500 strike and 23,200 strikes, indicating support for the index around these zones.

👉--------------------------------------------------------

The Nifty 50 showed a smart recovery of nearly 200 points from the day's low and closed flat with a negative bias on January 8, taking support at the upward-sloping support trendline (which comes to around 23,500). The index finished just below 23,700 (the 200-day EMA). This seems to confirm that the index remains in the range of 23,500–24,000 levels. Any fall below the lower band could take the index towards the 23,300 zone, but sustaining above 23,700 could bring positivity and push the index towards 24,000 (which is crucial for a further strong upward rally), experts said.

Levels For The Nifty 50(23,689)

Resistance based on pivot points: 23,743, 23,804, and 23,901

Support based on pivot points: 23,548, 23,488, and 23,390

The Nifty 50 has formed a small bearish candlestick pattern with a long lower shadow, resembling a Hammer pattern on the daily charts. This is a bullish reversal pattern formed in a downtrend, raising the possibility of an upside bounce in the upcoming sessions. However, the overall trend remains bearish, as the index traded below all key moving averages, and the momentum indicators—RSI (Relative Strength Index at 42.63)—remain in the lower band, while the MACD (Moving Average Convergence Divergence) stays below the zero line.

sunil Kumar matkar analysi-👈

--------------------------------------

Levels For The NiftyBank (49,835)

Resistance based on pivot points: 50,151, 50,354, and 50,681

Support based on pivot points: 49,497, 49,294, and 48,967

Resistance based on Fibonacci retracement: 50,455, 51,110

Support based on Fibonacci retracement: 49,276, 47,873

The Bank Nifty formed a bearish candlestick pattern with a sizeable lower shadow on the daily timeframe and sustained below all key moving averages, indicating weakness. The index fell by 0.73% and traded near the lower end of the Bollinger Band, but still held above the August low (49,650) on a closing basis. The momentum indicators RSI and MACD maintained a negative bias, signaling further weakness. Additionally, the index remained below the 50% Fibonacci retracement level (from the June low to the record high seen in September 2024), which also indicates a negative trend.

---sunil Kumar matkar analysis---

SENSEX

The SENSEX also started Wednesday's session on a negative note and recouped the intraday losses from the crucial support zone of 77,800. The index rallied over 600 points from the day's low and formed a bullish hammer candlestick pattern on the daily chart.

The index's technical structure remains range-bound, with immediate support at ₹77,800, corresponding to the low of the December 20 candle. A close below this level could extend weakness toward the ₹76,000 zone. Conversely, a sustained close above ₹80,000 would indicate strength and signal a potential trend reversal.

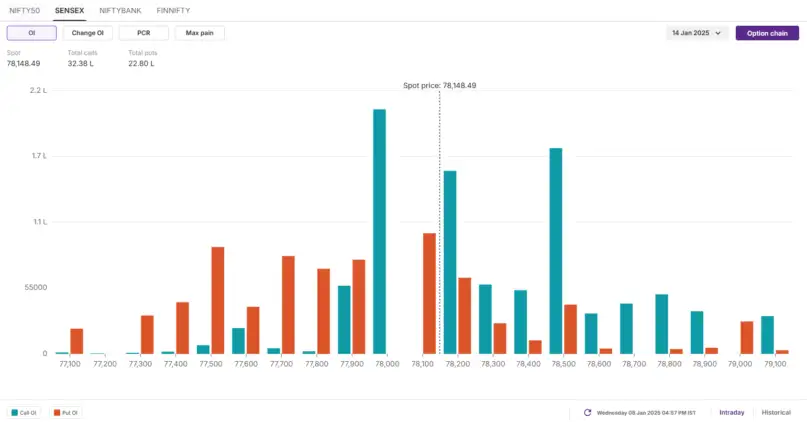

Open interest data for the January 14 expiry is dispersed, with a significant call base at the 79,000 strike and a put base at the 77,500 strike, establishing these levels as immediate resistance and support zones for the index. Additionally, substantial call and put activity at the 78,000 strike suggests potential consolidation around this level.

FII-DII activity

On January 8, Foreign Institutional Investors (FIIs) sustained their selling spree and sold shares worth ₹3,362 crore. Meanwhile, the Domestic Institutional Investors (DIIs) remained net buyers and bought shares worth ₹2,716 crore. To track the ratio of long and short open positions of FIIs in the index, log in to https://pro.upstox.com/ ➡️F&O➡️FII-DII Activity➡️FII Derivatives.

Asian markets @ 7 am

- GIFT NIFTY: 23,722.00 (-0.14%)

- Nikkei 225: 39,683.09 (-0.75%)

- Hang Seng: 19,294.99 (+0.08%)

U.S. market update

- Dow Jones: 42,635 (▲0.2%)

- S&P 500: 5,918 (▲0.1%)

- Nasdaq Composite: 19,478 (▼0.0%)

U.S. indices closed Wednesday's choppy session on a mixed note as investors reacted to reports that President-elect Donald Trump is considering declaring a national economic emergency to facilitate new tariffs.

Meanwhile, minutes from the U.S. Federal Reserve's December meeting highlighted plans for a gradual pace of rate cuts in 2025. Fed officials indicated that inflation is expected to continue trending toward the 2% target range. However, they cautioned that the process may take longer than anticipated due to potential changes in trade and immigration policies.

-----------------source: upstock&NSE-------------

No comments:

Post a Comment