NIFTY50

- January Futures: 23,648 (▼0.4%)

- Open interest: 5,45,648 (▲5.5%)

The NIFTY50 index remained under pressure on the weekly expiry of its options contracts and ended the day in red. The index failed to close above 8 January's high, invalidating the hammer candlestick pattern formed on daily chart.

As per the weekly chart, the index is giving early indication of the formation of bearish candle. A close below previous week's low and 50 weekly exponential moving average (EMA) will signal weakness. However, if the index protects crucial support zone of 23,500 and 23,300 on closing basis, the trend may remain range-bound.

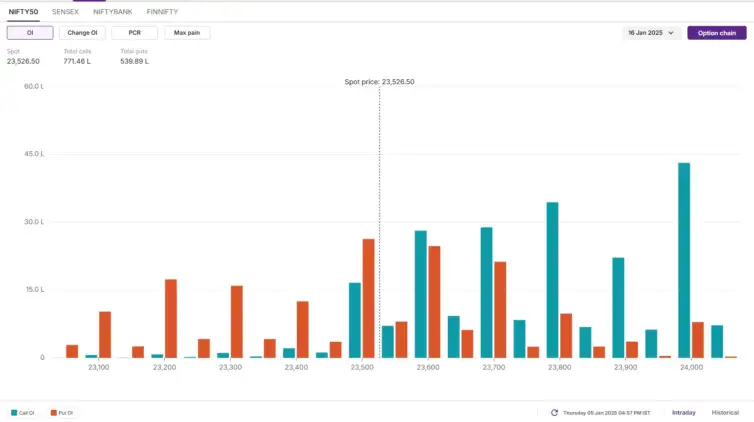

The open interest data for the 16 January expiry provides key insights. A significant call base was sustained at the 24,000 strike, suggesting that market participants anticipate resistance around this level. Conversely, the put base has been established at 23,500, albeit with relatively lower volume, indicating a less robust support zone.

-----------------------------------------

👉The Nifty 50 remained under pressure for another session, falling by seven-tenths of a percent on January 9, but managed to take support at 23,500, which coincides with an upward-sloping support trendline. Overall, the trend remains in favour of the bears, with momentum indicators in negative territory and the index trading below all key moving averages. According to experts, if the index fails to defend the 23,500 level in the upcoming sessions, a fall toward 23,263 (the November low) can't be ruled out. However, if it sustains above 23,500, it could open the door for a rebound toward the 23,900-24,000 zone, experts said.

Levels For The Nifty50 (23,527)

Resistance based on pivot points: 23,644, 23,688, and 23,759

Support based on pivot points: 23,502, 23,458, and 23,387

The Nifty 50 formed a bearish candlestick pattern on the daily charts, sustaining below the 200-day EMA of 23,700. As a result, the index remains below all key moving averages, with a negative bias in the momentum indicators. The RSI (Relative Strength Index) stands at 39.51 in the lower band, while the MACD (Moving Average Convergence Divergence) remains below the zero line, signaling a weak trend.

Levels For The Nifty Bank (49,504)

Resistance based on pivot points: 49,728, 49,862, and 50,079

Support based on pivot points: 49,294, 49,160, and 48,943

Resistance based on Fibonacci retracement: 50,329, 51,015

Support based on Fibonacci retracement: 49,278, 47,870

The Bank Nifty maintained lower highs for the fifth consecutive session, forming a bearish candlestick pattern with a sizeable lower wick on the daily charts. It is trading near the lower band of the Bollinger Bands, remaining well below all key moving averages. The momentum indicators (RSI and MACD) are also in a negative trend, signaling continued weakness.

------------By Sunil Shankar Matkar -------------👈

SENSEX

- Max call OI: 80,000

- Max put OI: 75,500

- (Expiry: 14 Jan)

The SENSEX also ended the Thursday's session near day's low, invalidating the hammer candlestick formed on 8 January. The index also surrendered crcuial support of 200 EMA on the daily chart, indicating weakness during upcoming sessions.

The daily chart reveals that the index invalidated the hammer candlestick pattern and lost the critical support level of 77,800, which corresponds to the low of the December 20 candle, on a closing basis.

While the broader trend remains bearish, traders should focus on the weekly closing. If SENSEX ends the week below 77,500 zone, this will signal weakness. On the flip side, a close below 78,500 will indicate range-bound activity for the upcoming session.

FII-DII activity

The Foreign Institutional Investors (FIIs) remained net sellers for the fifth consecutive day and offloaded shares worth ₹7,170 crore. Conversely, the Domestic Institutional Investors (DIIs) remained net buyers and purchased shares worth ₹7,639 crore. To track the ratio of long and short open positions of FIIs in the index, log in to https://pro.upstox.com/ ➡️F&O➡️FII-DII Activity➡️FII Derivatives.

No comments:

Post a Comment