He added that the earnings were expected to report 12-15% growth but the growth turned out to be 5-6% but "per say the earnings remain solid"

He also said the, "Bulk of correction is done...big ticket events will keep coming but on the whole Indian markets have shown resilience."

Both Sensex and Nifty 50 are trading at day's high as the benchmark indices have pushed passed their opening gains. The Nifty 50 index is trading 0.93% higher at 23,567.60 and Sensex is trading 0.94% higher at 77,626.44

"India is a naturally equity excretive market, but what spoils the part is the FIIs coming and selling", says Ajay SrivastavaMD at Dimensions Consulting.

Srivastava added that he expect FII inflows to pick-up over the next few months and that the only change that has taken place over the last weeks is that, "Market is oversold and it is right to pluck in"

He also said, "Don't think the next bull run has started, should wait for March 31 results"

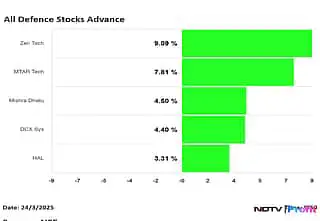

Shares in Nifty Defence posted gains as the market also opened in the green on Monday. Zen Technologies gained as much 9.60%, followed by MTAR Technologies which gained 9.38%.

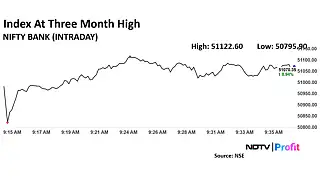

As the benchmark indices opened with gains on Monday the Nifty Bank jumped to nearly three-month high surging 1.05% to trade at 51,122.60 points.

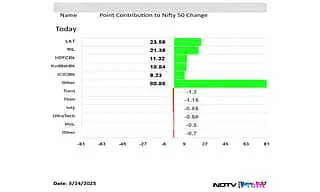

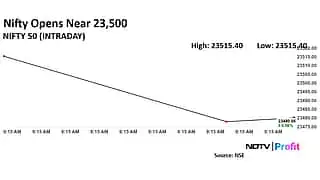

Nifty 50 index opened at 23,518 points on Monday. The top contributor in the surge was Larsen and Turbo with 23.59 points followed by Reliance with 21.39 points and HDFC Bank contributed 11.32 points.

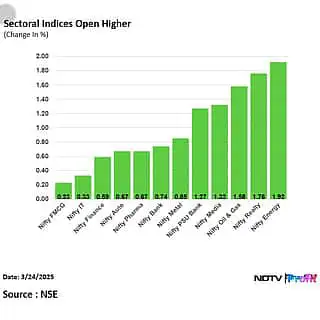

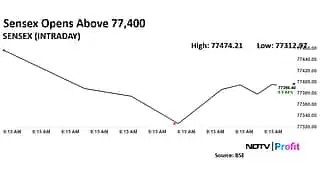

On Monday both Sensex and Nifty 50 opened higher and all 12 sectors of Nifty were also in green. The top gainer at market open was Nifty Energy, followed by Nifty Realty and Nifty Oil and Gas.

On Monday both Sensex and Nifty 50 opened with gains as they were trading above 0.70%. Nifty 50 opened 0.72% up at 23,518 and Sensex opened at 0.77% higher to trade at 77,498

At the start of the week's trading session, benchmark indices Nifty 50 and Sensex opened with gains at market pre open.

Nifty 50 was up 0.71% at 23,515 points meanwhile Sensex was up 0.72% at 77,456 points.

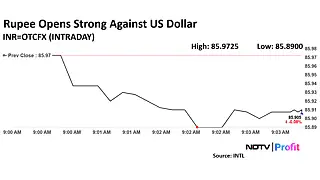

The rupee strengthened by 3 paise, opening at 85.94 against the US dollar. On Friday, it ended at 85.97 per dollar.

The yield on the 10-year bond opened flat at 6.64%, after closing at 6.65% on Friday.

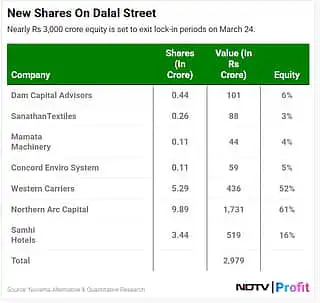

Shares worth over Rs 2,978 crore, including those of Dam Capital Advisors Ltd. and Samhi Hotels Ltd., are set to exit their lock-in periods on Monday.

For Dam Capital Advisors, 6% of its equity will become eligible for trade as it exits the second lock-in expiry period for anchor investors, which is set at 90 days post-allocation.

Brent Crude's May future contract declined in Monday's session to trade at $71.94, down 0.30%.

The volatility comes in the wake of second round of tariffs set to be imposed by US President Trump starting April 2.

This move will align with increased supply from the Organisation of the Petroleum Exporting Countries (OPEC) and its allies, who plan to restart idled production next month.

The group aims to boost output by 138,000 barrels a day, initiating a series of monthly increases, as per Bloomberg.

On March 24, gold prices in India were lower at Rs 88,210 per 10 grams, according to the India Bullion Association.

In New Delhi, the rate was Rs 87,890 per 10 grams, while in Mumbai, it was Rs 88,050.

Kolkata saw a lower rate at Rs 87,930, and Bengaluru's rate was Rs 88,120. Chennai continued to have one of the highest rates in the country at Rs 88,300 per 10 grams.

The week's start saw Asian markets mixed as the countries brace for updates on U.S. President Donald Trump's plans for global reciprocal tariffs starting April 2.

Japan's Nikkei's was trading flat at 37,664 points as it was down 13.92 points. Meanwhile, Hong Kong's Hang Seng index was also flat as it was trading at b23,682 points on Monday.

China's CSI 300 was up 0.47% at 3,933 points and Australia's S&P 200 was down 0.05% at 7,927. South Korea's Kospi was flat as it traded at 2,643 points.

US markets saw a late-day rebound driven by a rally in tech giants, despite earlier selloffs due to disappointing outlooks from key industry players.

The S&P 500 erased a significant slide just five minutes before closing, ending 0.08% higher at 5,667.56.

The Dow Jones Industrial Average also closed 0.08% higher at 41,985, while the Nasdaq Composite rose 0.52% to 17,784.05.

Tesla led gains among megacaps, though Nvidia fell. Boeing surged on a new fighter jet contract, while forecasts from FedEx, Nike, and Lennar disappointed traders. A massive options expiration added to the day's volatility, with over 21 billion shares traded.

On the first trading session of the week the Gift Nifty was trading near the 23,500 mark as it rose 0.10%.

Among stocks that are expected to react are IndusInd Bank Ltd., as the lender is on the lookout for a new CEO. Shares of Larsen & Toubro Ltd. are also expected to react, as the company approved a long-term borrowing of up to Rs 12,000 crore.

Godrej Properties Ltd. shares could also see movement as the company acquired 10 acres of land in Yelahanka, Bengaluru, with the revenue potential of Rs 2,500 crore.

JSW Energy Ltd. stock may also react due to management change, as the company's director Ashok Ramachandran is set to resign due to personal reasons.

The domestic stock markets rose on Friday, marking their strongest weekly gains in years. Investors disregarded global market concerns, capitalising on discounted stocks, following a recent correction. The NSE Nifty 50 closed at 23,350.40, up 0.69% or 159.75 points, while the BSE Sensex rose 0.73% or 557.45 points to 76,905.51. Both indices reached intraday highs of 23,402.70 and 77,041.94, respectively.

source: NDTV Profit

No comments:

Post a Comment