However, sentiment improved during the week as the U.S. announced a 90-day pause on these tariffs for all countries except China. The policy shift helped the major indices recover the majority of their early losses, although they still ended the week in the red.

The NIFTY50 index closed the week at 22,828, rebounding over 1,100 points from week's low and formed a bullish candle on the weekly chart. Meanwhile, the Nifty Midcap 100 dipped 0.3%, and the Smallcap 100 edged up 0.1%, reflecting resilient performance across broader markets.

Sector-wise, Consumer Durables (+3.7%) and FMCG (+2.3%) led the recovery, posting the strongest gains of the week. On the flip side, Real Estate (-4.0%), Metals (-2.9%), and IT (-2.3%) were the major laggards, dragging overall market performance.

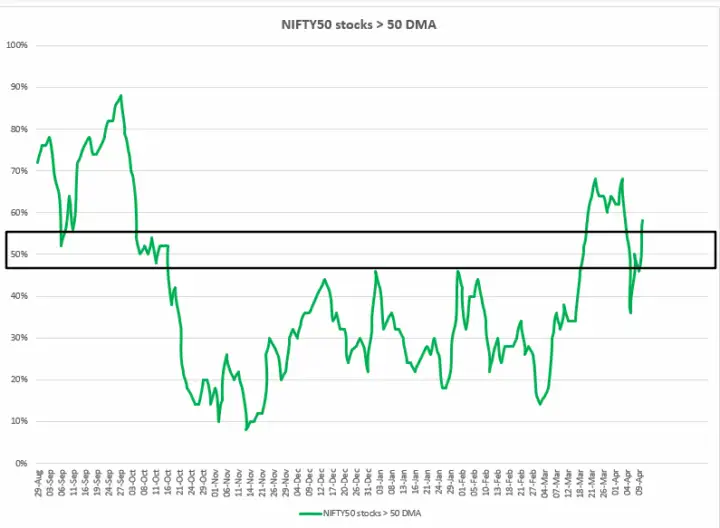

Index breadth

The NIFTY50 index saw a strong mid-week recovery after the percentage of stocks trading above their 50-day moving average (DMA) dropped to just 36%. A broad-based rebound across sectors helped lift sentiment, pushing this figure back above the halfway mark to end the week at 58%. The sharp turnaround suggests that short-term market breadth remains positive, with improving participation across the index.

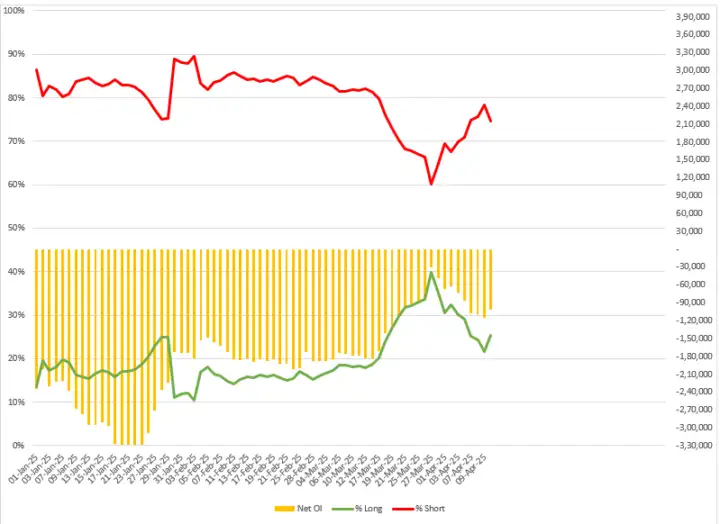

FIIs positioning in the index

The Foreign Institutional Investors (FIIs) sustained their bearish bets on index futures and further shifted the long-to-short ratio in favour of bears to 25:75. They started the April expiry with the long-to-short ratio 35:65 and the net open interest of -49,057 contracts. As of 11 April, their net open interest of FIIs on index futures deepened to -1.01 lakh contracts. This indicates that the broader positioning of the FIIs remains bearish. However, it is important to monitor the change in the long-to-short ratio for further directional clues. To track this ratio, you can login https://pro.upstox.com/ ➡️F&O➡️FII-DII activity➡️FII Derivatives.

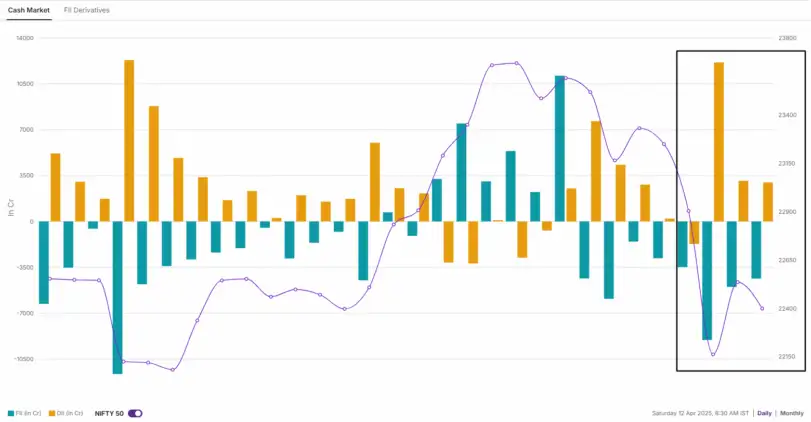

Meanwhile, the cash market activity of the FIIs last week was in line with their bearish bets on index futures. They offloaded shares worth ₹20,911 crore. On the flip side, the Domestic Institutional Investors (DIIs) remained net buyers and purchased shares worth ₹21,955 crore.

NIFTY50 outlook

From a technical perspective, the NIFTY50 index formed a bullish marubozu candle on the weekly chart, protecting the March low (21,964) on a closing basis. The index bounced back sharply from the weekly low by over 1,000 points, indicating support based buying from lower levels. Furthermore, after a strong rebound, the index could extend its gains to the 21 and 50 weekly exponential averages (EMAs). Unless the index reclaims these levels on a closing basis, the trend may remain sideways to positive with support around 21,700 zone.

SENSEX outlook

The SENSEX also formed a bullish marubozu candle on the weekly chart and made a sharp recovery of over 3,700 points, signaling strong buying interest emerging at key support levels. SENSEX also protected the March month low (72,633) on a closing basis.

In the upcoming sessions, the index faces immediate resistance near the weekly 21 and 50 EMAs. A decisive close above these levels, especially above the key resistance zone around 78,700, could provide clear directional clues. Until then, the index is likely to remain in a broad consolidation range between 79,500 and 72,600.

️Key events in focus: On the global front, U.S. retail sales data for March will be closely watched, with a particular focus on consumer spending. Housing data will also be in the spotlight. On Thursday, housing starts for March will provide a snapshot of supply in a market.

On the domestic front, India's retail inflation data will be in focus. In February, inflation fell to a lower-than-expected 3.61% amid a softening in vegetable prices. Meanwhile, experts expect inflation to cool further, supported by the fall in food prices. In addition, the Reserve Bank of India in its meeting last week projected inflation to fall to 4% in FY26 from the previous forecast of 4.2%.

Earnings blitz: Globally, Goldman Sachs will be the key company to release its quarterly results, followed by Bank of America and Citigroup on Tuesday. The earnings week concludes on Thursday with big names such as American Express, Blackstone, Charles Schwab, Netflix and Taiwan Semiconductor. In India, the key companies declaring fourth quarter earnings will be IREDA, ICICI Prudential, Wipro, Infosys, HDFC Life, HDFC MC, ICICI Bank and HDFC Bank.

Spotlight: India VIX, the volatility index, spiked above 20-its highest close in a year-as uncertainty around the ongoing tariff war continued to weigh on sentiment. The investor sentiment improved after the U.S. President Donald Trump announced a 90-day pause on his reciprocal tariff plans for all countries except China. He confirmed that total tariffs on Chinese goods will now reach 145%, factoring in the existing 20% duties. However, in a partial relief, the U.S. clarified that smartphones, computers, and semiconductors will be exempt from the new tariffs.

Mark your calendars: The upcoming week will be a shortened one, with Indian markets closed on April 14 for Ambedkar Jayanti and again on April 19 for Good Friday. U.S. markets will also remain shut on April 19 in observance of Good Friday.

️Oil: Oil prices fell to near four-year lows amid escalating trade tensions between the U.S. and China. Although prices recovered some ground but both Brent Crude and WTI still ended the week down over 1% at $64 and $61 respectively. Contributing to the downside pressure, the U.S. Energy Information Administration (EIA) cut its global oil demand forecast for 2025 by 4,00,000 barrels per day, bringing it down to 9,00,000 barrels per day, citing the impact of the trade war.

Stocks in focus: Based on price and open interest (OI), the stocks which witnessed long build-up are PI Industries, Deepak Nitrite, Aarti Industries and SRF. Similarly, to track the OI and price losers, log in to Upstox ➡️F&O➡️Futures smart list ➡️OI losers.

✏️Takeaway: The NIFTY50 index formed a bullish candle on the weekly chart and protected the March low on a closing basis, suggesting a positive rebound in the short term. However, the broader trend remains bearish with a lower high and lower low formation with immediate resistance at 23,800.

Meanwhile, the index may consolidate between 23,800 and 21,700 after a sharp rebound of over 1,000 points. A break of this range on a closing basis will provide further directional clues.

source: Upstox

Disclaimer:

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client, and such material should not be redistributed. We do not recommend any particular stock, securities, or trading strategies. The securities quoted are exemplary and not recommendatory. The stock names mentioned in this article are purely to show how to do analysis. Make your own decision before investing.

No comments:

Post a Comment