Similarly, the BANK NIFTY index set a new record, closing at 57,443, up 2% over the week.

The sharp momentum was driven by significant buying activity from foreign investors, which boosted overall market sentiment. The announcement of a ceasefire between the United States, Israel, and Iran further contributed to positive investor sentiment, as did a sharp decline in crude oil prices. Additionally, a notable drop in the volatility index (VIX) provided further support, encouraging bullish trends across key sectors.

The broader markets outperformed the benchmark peers with NIFTY Midcap 150 index surged over 2%, while the NIFTY Smallcap 250 index rose over 4%. Sectorwise, Metals (+4.8%), Consumer Durables (+3.4%) and Oil & Gas (3.2%) were the top gainers, while Realty (-1.9%), Defence (-1.1%)and IT (-0.4%) lost the most.

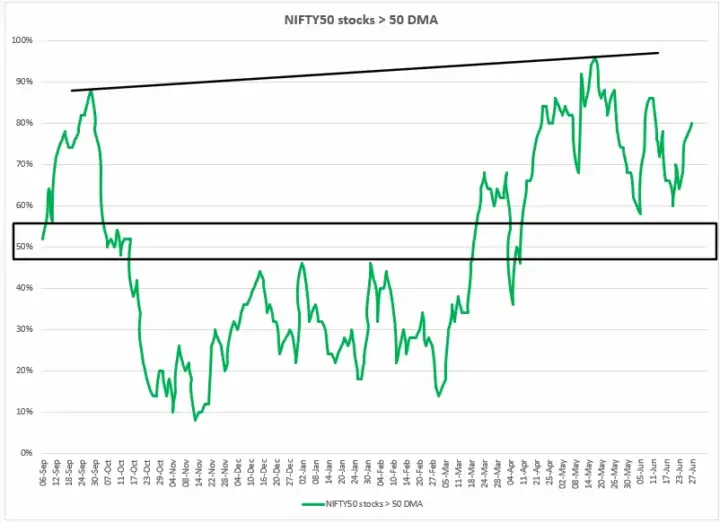

Index breadth

The NIFTY50 index sustained its positive momentum, with the breadth of the index-measured by the percentage of stocks trading above their 50-day moving averages-showing notable improvement. The week began with 68% of NIFTY50 stocks above this key technical level and rebounded impressively to 80% by the end of the week.

As highlighted in the chart below, the index breadth has consistently remained above the critical 50% threshold since March 2025, underscoring the ongoing strength in the market. The first indication of weakness will likely emerge only if the measure falls below the 50% threshold.

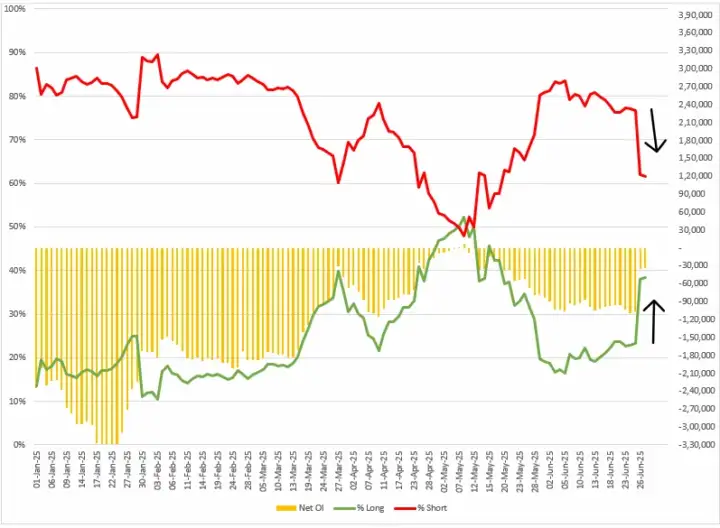

FIIs positioning in the index

Foreign Institutional Investors (FIIs) covered all their short contracts on the day of monthly expiry and started the July series with the long-to-short ratio of 38:62. The net open interest of the index futures of FIIs now stand at -33,518 contracts, indicating that the broader positioning of the FIIs still remains bearish.

However, it is important to note that the broader trend of the index remains bullish. For short-term clues, traders can monitor the addition and unwinding of the open interest in the long-to-short ratio. To track this ratio, you can login https://pro.upstox.com/ ➡️F&O➡️FII-DII activity➡️FII Derivatives.

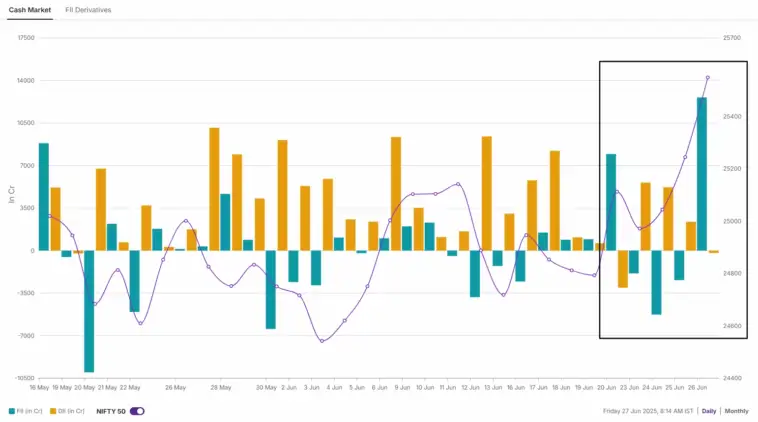

The short-covering of the FIIs in the index futures was in line with their cash market activity. They remained net buyers for the third week in a row and purchased shares worth ₹6,613 crore. Meanwhile, the Domestic Institutional Investors remained net buyers and purchased shares worth ₹9,121 crore.

NIFTY50

The NIFTY50 index broke out of its five-week consolidation range. It formed a bullish Marubozu candle on the weekly chart, reclaiming the crucial 25,250 resistance zone on a closing basis. This indicates a fresh entry of buyers from the crucial support zones.

Over the next week, the index may sustain bullish momentum and consolidate its gains at higher levels following a sharp rise. The index has immediate support around the 25,200 zone, and a pullback towards this level could prompt fresh buying activity. However, closing below this level would signal a change in the short-term trend.

Oil & Gas

The NIFTY Oil & Gas index surged over 3% last week, forming a strong bullish candle on the weekly chart as it decisively broke out of a five-week consolidation. Additionally, the index experienced a bullish crossover of its 21-week and 50-week exponential moving averages, signaling a potential shift in momentum and suggesting that the sector is entering a sustained uptrend with increasing buying interest. This rally is supported by easing geopolitical tensions following the Israel-Iran ceasefire, which led to a sharp decline in crude oil prices. Against this backdrop, shares of Hindustan Petroleum , Adani Total Gas , Mahanagar Gas and Bharat Petroleum advanced in the range of 6% to 12%.

️Key events in focus: Globally, the focus will be on the U.S.'s monthly jobs data. The June nonfarm payrolls report is particularly important because a weak job market could lead to speculation about an early interest rate cut. Currently, markets are expecting only a 20% chance of a cut in July, with most anticipating it in September. Other important data includes the ISM manufacturing report for June on Tuesday and the services activity report on Thursday. Both reports will show the effect of trade tariffs on the economy.

Domestically, the auto sales data for June will be in focus. In the month of May Maruti retained its top spot, while Hyundai replaced Tata Motors in third spot and Mahindra continues to retain the second spot.

Spotlight: Market sentiment has improved, but concerns persist about potential tariff increases, especially with U.S. tariffs set to resume on July 9. Updates on trade agreements remain a key focus. Recently, the U.S. President announced on social media that a deal has been signed with China and suggested a possible agreement with India, though details are still unclear. Markets will be closely watching for more clarity on these developments.

️Oil: Crude oil prices crashed over 12% after the announcement of ceasefire between Iran and Israel war. The oil market remains sensitive to geopolitical risks, but stable supply conditions and excess OPEC capacity have limited sustained price gains. Experts believe that oil could stabilize near $70 per barrel if the ceasefire holds and no major supply disruptions occur. For the week, the West Texas Intermediate tumbled 12% and closed at $66.

Mark your calendars: U.S. stock markets will be closed on Friday, July 4, 2025, for Independence day.

✏️Takeaway: Following last week's analysis, the index has now closed above the 25,250 resistance level. This confirms the bullish signal indicated by the harami candlestick pattern. The breakout suggests renewed upward momentum and could pave the way for further gains in the near term. For the upcoming sessions, traders should monitor the support zone of 25,250. A retracement towards this level could attract further buying interest and pave the way for the next upward movement.

IPO listing: Six mainboard IPOs will make their stock market debut this week, including HDB Financial Services, Kalpataru Ltd and others. Investors who got allotment in these IPOs are looking forward to listings.

Disclaimer:

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client, and such material should not be redistributed. We do not recommend any particular stock, securities, or trading strategies. The securities quoted are exemplary and not recommendatory. The stock names mentioned in this article are purely to show how to do analysis. Make your own decision before investing.

source: Upstox

No comments:

Post a Comment