The benchmark equity indices continued to decline for the second straight day on Wednesday, dragged by share prices of ICICI Bank Ltd. and Tata Consultancy Services Ltd. The NSE Nifty 50 ended 41.35 points or 0.17% lower at 24,812.05, while the BSE Sensex closed 138.64 points or 0.17% down at 81,444.66.

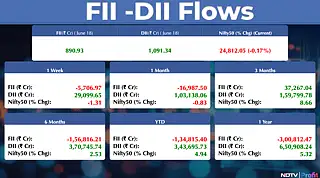

Foreign portfolio investors remained net buyers of Indian equities for the second consecutive session on Wednesday, mopping stocks worth Rs 891 crore, according to the provisional data from the National Stock Exchange. Domestic institutional investors continued to stay net buyers for the 24th straight session as they obtained equities worth Rs 1,091.3 crore, the data showed.

The Securities and Exchange Board of India conducted its 210th board meeting on Wednesday and several big-ticket market reforms were discussed. Important points discussed include:

Easing rules for foreign investors in government bonds.

Rolling out of NSEL settlement scheme for NSEL stockbrokers.

Allowing startup founders to hold ESOPs granted a year before going public.

Allowing delisting relaxations for PSUs through fixed price process.

Read full text here.

S&P 500 futures declined 0.3%.

Futures linked to Hong Kong's Hang Seng Index fell 0.5%.

Japan's Topix index was down 0.6%.

Australia's S&P/ASX 200 slipped 0.2%.

Euro Stoxx 50 futures dropped 0.4%.

The downturn comes as Wall Street erased its gains following Fed's decision to hold rates steady, coupled with Powell's latest warning on tariffs. The US stocks ended the session little changed with S&P 500 index closing 0.03% lower at 5,980.87, Nasdaq 100 index ended flat at 21,719.69 and Dow Jones Industrial Average fell 0.10% to 42,171.66.

WTI declined for the third consecutive trading session, down 0.19%.

Brent crude declined 0.85% lower.

Copper ended 0.5% lower.

Aluminium snapped two day gaining streak and ended 0.02% higher.

Zinc ended flat after it posted losses in the last session.

Nickel also ended flat after declining for eight consecutive trading session.

Lead slumps for the fourth consecutive trading session, down 0.18%.

Vodafone Idea: The company signed an agreement with AST Spacemobile to expand mobile connectivity and bring direct-to-device satellite broadband connectivity.

Garware Technical: The company incorporated wholly owned subsidiary Garwares Technical Fibres AS in Norway.

ESAF Small Finance Bank: The bank approved the proposal for sale of NPA, written-off loans to Asset Reconstruction Company.

Aavas Financiers: The company approved issuance of NCDs worth Rs 200 crore.

Hero Motocorp: The company to introduce Vida VX2 with Battery-As-A-Service Model. Pay-as-you-go' battery subscription model to make VIDA Electric Vehicle ownership more flexible, affordable.

Jio Financial Services: The company acquired 7.9 crore shares of Jio Payments Bank from SBI for Rs 105 crore. Post Acquisition Jio Payments Bank becomes wholly owned subsidiary of the company.

Zydus Lifesciences: TheUSFDA closes inspection at Ahmedabad plant with 2 observations. The inspection was from June 9 to 18.

Inox Green Energy: Promoter Devansh Trademart further acquired 30,000 shares of the company via open market transactions.

EL CID Investment: Ragini Vakil resigned as Chief Financial Officer. The company appointed Shraddha Manjrekar as CFO effective June 19.

South Indian Bank: The company revised MCLR applicable for multiple tenors effective from June 20.

Axiscades: The company to expand strategic cooperation with MBDA. The company has undertaken built-to-spec and built-to-print assignments on Test Benches for MBDA.

Himadri Speciality Chemical: Birla Tyre unveils new brand along with the logo and website.

Choice International: The company is in an agreement to acquire a further 50% stake in arm for Rs 62.5 crore.

Ashoka Buildcon: The company arm and company received work orders for Intelligent traffic management projects across Maharashtra.

Medplus Health Services: The arm received four suspension orders for drug licenses for Telangana, Tamil Nadu, Karnataka stores.

Morepen Labs: The company incorporated wholly owned subsidiary Morepen Labs-FZCO in UAE.

Siemens: Siemens Energy India received an approval from BSE, NSE for listing and trading.

Tata Elxsi: The company signed an MoU with Infineon to jointly develop EV solutions tailored for Indian market.

Puravankara: The company arm received a work order worth Rs 272 crore from TRU Dwellings.

Arisinfra Solutions: The public issue was subscribed to 0.24 times on day 1. There were no bids were by qualified institutional investors, while non-institutional investors bid 0.19 times, and retail investors bid 1.04 times.

Inventurus Knowledge Solutions: Multiple individual sellers are looking to sell up to 1.5% stake each via block deals today at an indicative offer price of Rs 1,650, a 3.2% discount to the current market price, with the total offer size, including the greenshoe option, standing at Rs 416 crore, and ICICI Securities serving as the sole merchant banker to the deal.

SKY Gold and Diamonds: Mangesh R Chauhan HUF sold 26.5 lakh shares (1.8%) at Rs 348.08 apiece, Darshan R Chauhan HUF sold 26.5 lakh shares (1.8%) at Rs 348.08 apiece, Mahendra C Chauhan Huf sold 17 lakh shares (1.15%) at Rs 351.01 apiece, Perundevi Krishnan sold 10.3 lakh shares (0.7%) at Rs 345.79 apiece, Bank Of India Mutual Fund bought 7.8 lakh shares (0.53%) at Rs 346 apiece.

Hindustan Zinc: Vedanta Limited sold 6.67 crore shares (1.57%) at Rs 454.05 apiece.

NCL Industries: Promoter P Varalakshmi (Revised) sold 50,355 shares.

Bharat Bijlee: Promoter Anand J. Danani sold 3500 shares.

Crest Ventures: Promoter Priyanka Finance Private bought 66,001 shares.

Usha Martin: Promoter Peterhouse Investments India Ltd. sold 1.5 lakh shares.

Jtekt India: Promoter Jtekt Bearings India Private Limited bought 10000 shares.

Geojit Financial Services: Promoter BNP Paribas Sa sold 3 lakh shares.

Insolation Energy: Promoter Vikas Jain HUF bought 2000 shares.

Aarti Pharmalabs: Promoter Orchid Family Trust sold 75,000 shares.

Price Band change from 10% to 5%: Excel Realty N Infra.

List of securities to be included from LT-ASM Framework: Subros,

List of securities to be included from ST-ASM Framework: Puravankara, Kernex Microsystems, Cosmo First.

Ex- Dividend: Reliance Industrial Infrastructure, Tejas Networks, Tata Communications.

Shares to Exit Anchor Lock-In: Indian Shelter Finance (21%).

Nifty June Futures down by 0.22% to 24,813 at a premium of 1 points.

Nifty June futures open interest down by 3.14%.

Nifty Options June 19 Expiry: Maximum Call open interest at 25,000 and Maximum Put open interest at 24,000.

Securities in ban period: Aditya Birla Fashion,Birlasoft,CDSL,Chambal Fertilizers, HUDCO, IREDA, Manappuram, RBL Bank, Titagarh.

The Indian rupee closed 23 paise weaker against the US dollar at 86.47.

The yield on the benchmark 10-year government bond ended flat at 6.32%.

source: NDTV Profit

No comments:

Post a Comment