The brokerage's August list spans sectors such as retail, electronics manufacturing, spirits, packaging, and water treatment.

Vishal Mega Mart

Motilal Oswal has a target price of Rs 165 on Vishal Mega Mart, implying an upside of about 13% from current levels. According to the brokerage, Vishal Mega Mart remains one of India's largest value retail chains, with a footprint of 696 stores across 458 cities. What sets the company apart is its deep penetration into Tier-2 and smaller towns, with around 72% of its network located in these markets.

Furthermore, the brokerage in its report noted that The retailer's product mix is well-diversified, with apparel contributing 44%, and FMCG and general merchandise around 28% each. Significantly, 73% of its revenue comes from private brands.

With a 50% RoCE and double-digit same-store sales growth, Vishal Mega Mart has a strong store-level profitability. "We expect revenue/PAT CAGR of 19%/24% over FY25-28, driven by steady store additions and margin gains," the brokerage added, highlighting cumulative operating cash flow of Rs 32 billion over the next three years as a funding cushion.

Kaynes Technology

For Kaynes Technology, Motilal Oswal has set a target price of Rs 7,300, offering an upside of around 15%. The electronics manufacturing services (EMS) player in the first quarter of FY26, delivered revenue and EBITDA growing 34% and 69% year-on-year, respectively. Margins expanded sharply to 16.8%.

Management has reiterated its FY26 revenue guidance of Rs 45 billion and expects margins to "remain elevated." Furthermore, the brokerage noted that the recent acquisitions have broadened its global footprint, with a push toward original design manufacturing (ODM) for higher profitability.

The brokerage forecasts a revenue/adjusted PAT CAGR of 58%/74% over FY25-27.

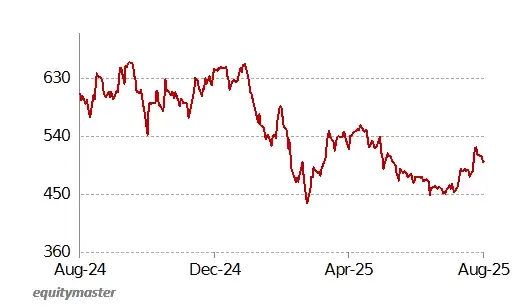

Radico Khaitan

Radico Khaitan comes with a target price of Rs 3,250 from Motilal Oswal, implying an upside of about 13%.

The company commands roughly 8% of the Rs 200-million Prestige & Above segment. In Q1FY26, Radico Khaitan's standalone net sales surged 32% YoY to Rs 15.1 billion, exceeding estimates. Volumes grew 38%, with premium and above categories up 41%, while regular segments jumped 52%.

Motilal Oswal expects revenue, EBITDA, and APAT to grow at CAGRs of 16%, 22%, and 30% respectively through FY25-28.

Time Technoplast

With a target price of Rs 578 and an upside potential of 24%, Time Technoplast is another high-conviction pick for the brokerage.

The company is betting on value-added composite products and expects to become net cash positive by FY27, supported by annual free cash flow of Rs 4 billion. According to Motilal Oswal, "We estimate a CAGR of 15%/16%/23% over FY25-28 in revenue/EBITDA/PAT, driven by growth in the value-added products segment and strong financial discipline."

VA Tech Wabag

The final pick, VA Tech Wabag, carries a target price of Rs 1,900, suggesting an upside of 23%.

An order book of Rs 137 billion, 4.2x its FY25 revenue and a bid pipeline of Rs 200 billion provide clear visibility for 15-20% revenue CAGR over FY25-28. The company focuses on high-margin engineering, procurement, and long-term O&M contracts, backed by strategic initiatives like 'Wriddhi' to enhance profitability.

source: FinancialExpress

No comments:

Post a Comment