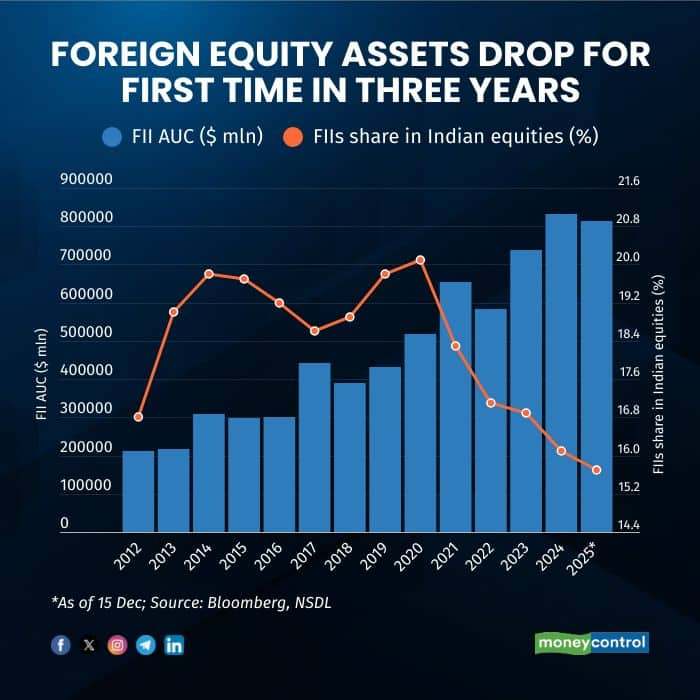

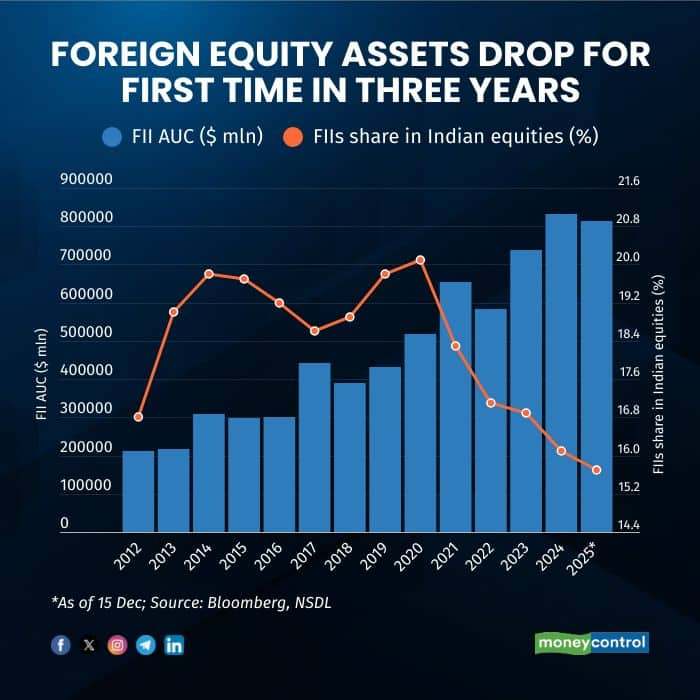

Foreign investors' equity holdings in India fell for the first time in three years in 2025, amid sustained outflows, pushing their market share to a 14-year low.Overseas portfolio investors' share in Indian publicly traded equities has fallen to 15.5 percent, its lowest level since 2011, NSDL data showed. Their equity assets under custody stood at $815 billion as of December 15, down 2.1 percent from $832 billion at the end of 2024, the steepest fall since 2022.

Since January, foreign funds have pulled out nearly $17.97 billion from India's equity markets, even as benchmark indices have remained resilient. The Sensex and Nifty have each gained close to 9 percent in 2025. In contrast, domestic institutional investors have injected more than Rs 7.63 lakh crore into equities this year, lifting their ownership to a record 18.26 percent in the September quarter. DIIs first overtook foreign investors in March, and the widening gap underscores how local money has become the primary anchor for Indian markets.India has been one of the more affected emerging markets in 2025 as foreign investors trimmed exposure amid premium valuations and earnings downgrades. However, the valuation premium of MSCI India versus MSCI Emerging Markets has now slipped below its long-term average, a development analysts say could set the stage for firmer performance in 2026.For nearly two years, an AI-driven global narrative has channelled capital toward technology-heavy markets, leaving sectors such as industrials, consumer discretionary and financials relatively under-owned in India. With signs that the AI trade may be losing intensity, strategists believe foreign investors could begin rotating back to these segments.Even so, India has not been alone in facing pressure. While FIIs have sold more than $30 billion of Indian equities over the past 14 months, selling has been sharper across parts of Asia. Taiwan has seen cumulative foreign outflows of $103 billion over six years, while Korea has recorded $28 billion. Thailand and the Philippines have witnessed exits of $17 billion and $4 billion, respectively, whereas Indonesia has stood out with inflows of $3.7 billion.Analysts said foreign investors still hold much of the $43 billion invested between the second quarter of 2022 and the third quarter of 2024, reflecting India's underweight position relative to other large Asian markets. While foreign investor behaviour historically follows clear cycles, it remains uncertain whether the current downcycle has reached its bottom, they added.

Report by Mr Ravindra for Network18

No comments:

Post a Comment