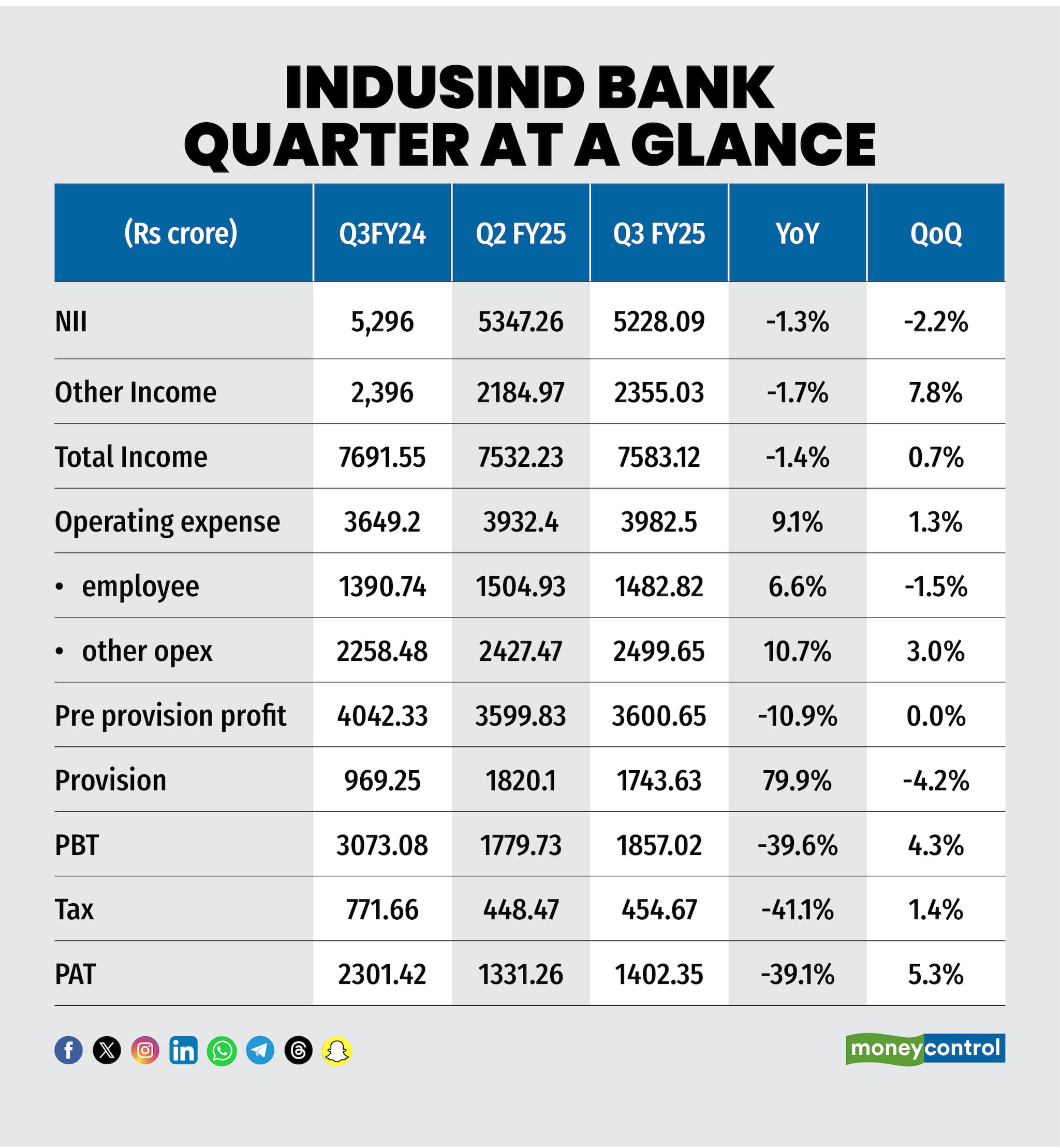

IndusInd Bank (IIB, CMP: Rs 1009 Market Cap: Rs 78,656, Rating: Overweight) had a weak Q3FY25 with tepid business growth, fall in net interest margin, and a higher slippage to NPAs (non-performing assets), principally all stemming from the ongoing asset quality challenges in the micro-finance space. However, the good news is that incremental stress in micro-finance seems to be peaking out and should start reflecting from Q1 of FY26.

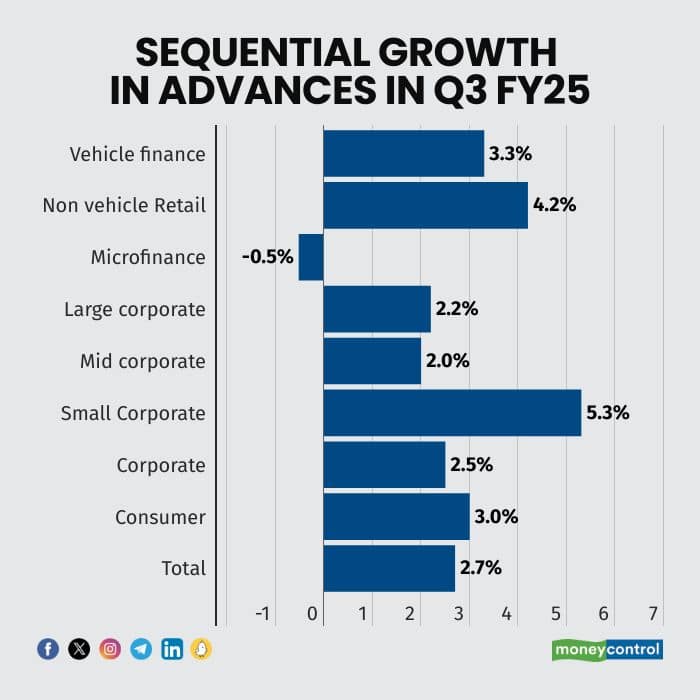

Q3 FY25 – a weak quarter Source: CompanyWhile the pre-provision operating profit growth was flat sequentially, core operating profit (excluding trading gains) declined by close to 5 percent sequentially due to higher trading gains in the quarter.Loan growth continues to feel the heatIIB's loan growth momentum decelerated with loans growing 12.2 percent YoY and 2.7 percent sequentially. The bank is growing its book in a calibrated manner given the challenges in the unsecured businesses. Vehicle finance as well as micro-finance disbursements, however, were sequentially better.

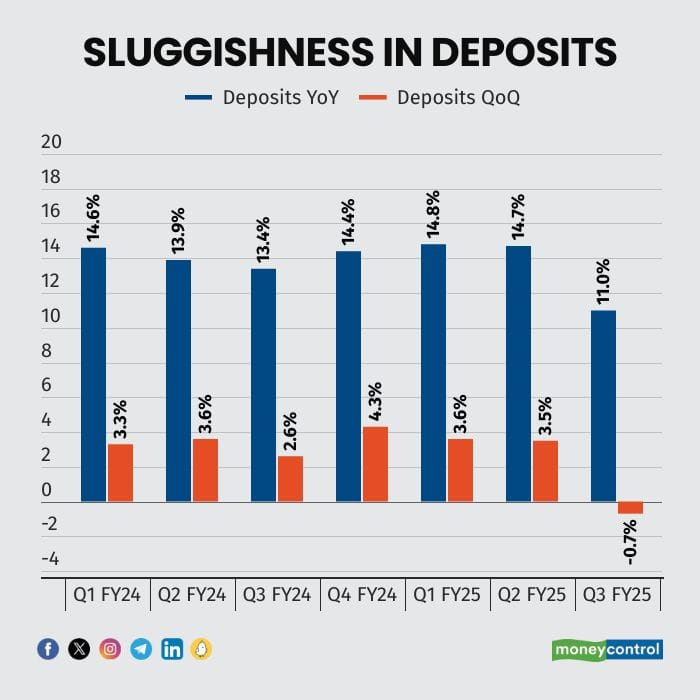

Source: CompanyWhile the pre-provision operating profit growth was flat sequentially, core operating profit (excluding trading gains) declined by close to 5 percent sequentially due to higher trading gains in the quarter.Loan growth continues to feel the heatIIB's loan growth momentum decelerated with loans growing 12.2 percent YoY and 2.7 percent sequentially. The bank is growing its book in a calibrated manner given the challenges in the unsecured businesses. Vehicle finance as well as micro-finance disbursements, however, were sequentially better. Source: CompanyGiven the strain in the high-yielding pockets, the bank has slowed down on high cost deposits, resulting in an elevated credit-to-deposit ratio of close to 90 percent. We therefore do not see loan growth gaining traction in a hurry.De-focusing on costly depositsIn view of the slack in loan growth, especially in the unsecured high-yield business, the bank is growing its deposits cautiously, de-focusing on high cost deposits, to protect its interest margin. While overall deposits de-grew, retail deposit mobilisation was healthy with 4 percent sequential and 14 percent YoY growth. The share of retail deposits improved sequentially by 200 basis points to 46.1 percent. The bank deliberately de-focused on wholesale deposits. Because of some outflows from the Current Account, the low-cost CASA share also declined quarter over quarter by 100 basis points to 35 percent. Deposits will continue to remain an area of focus.

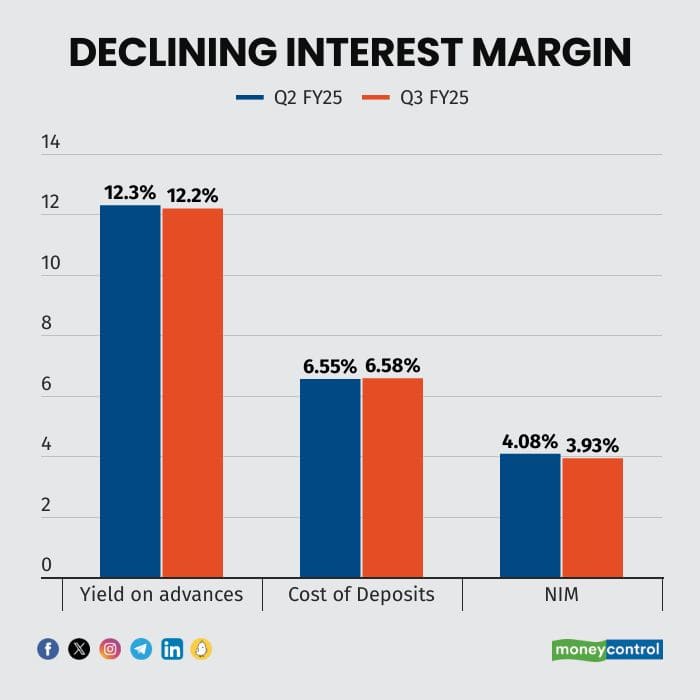

Source: CompanyGiven the strain in the high-yielding pockets, the bank has slowed down on high cost deposits, resulting in an elevated credit-to-deposit ratio of close to 90 percent. We therefore do not see loan growth gaining traction in a hurry.De-focusing on costly depositsIn view of the slack in loan growth, especially in the unsecured high-yield business, the bank is growing its deposits cautiously, de-focusing on high cost deposits, to protect its interest margin. While overall deposits de-grew, retail deposit mobilisation was healthy with 4 percent sequential and 14 percent YoY growth. The share of retail deposits improved sequentially by 200 basis points to 46.1 percent. The bank deliberately de-focused on wholesale deposits. Because of some outflows from the Current Account, the low-cost CASA share also declined quarter over quarter by 100 basis points to 35 percent. Deposits will continue to remain an area of focus. Source: companyMargin under pressureThanks to the improving composition of deposits, the sequential increase in the cost of deposits was restricted to 3 basis points. However, due to the decline in the yield on advances thanks to the compression in retail yield because of lower unsecured, the interest margin of the bank saw a huge decline of 15 basis points sequentially.With a large fixed-rate book, the bank stands to gain in the event of a rate cut, once the situation on the ground for micro-finance improves.

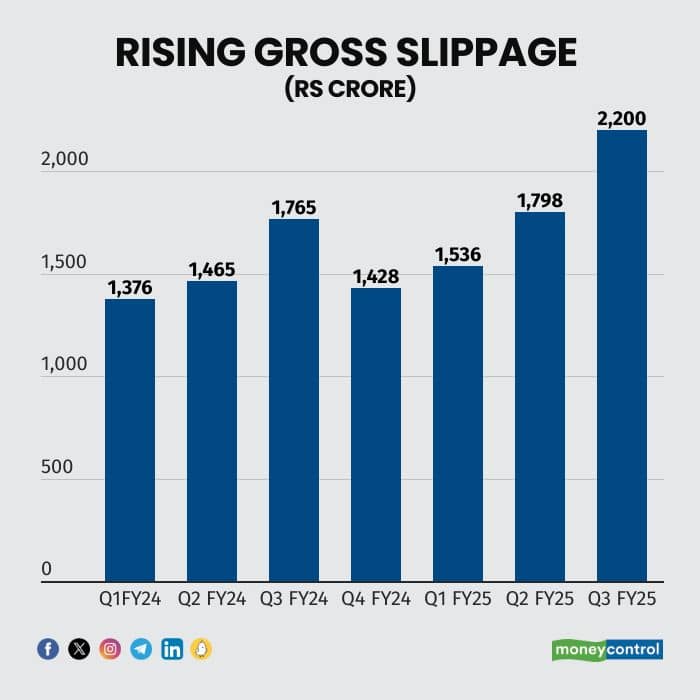

Source: companyMargin under pressureThanks to the improving composition of deposits, the sequential increase in the cost of deposits was restricted to 3 basis points. However, due to the decline in the yield on advances thanks to the compression in retail yield because of lower unsecured, the interest margin of the bank saw a huge decline of 15 basis points sequentially.With a large fixed-rate book, the bank stands to gain in the event of a rate cut, once the situation on the ground for micro-finance improves. Source: CompanySlippage remains elevatedThe overall slippage to NPAs remains elevated and were sequentially higher. In addition to retail – mostly from the vehicle book and micro-finance; there was a slippage from the corporate book of Rs 281 crore, mainly contributed by one restructured real estate account. Thanks to the higher write-off of Rs 984 crore, the gross and net NPA stood at 2.25 percent and 0.68 percent respectively with a provision cover of 70 percent.

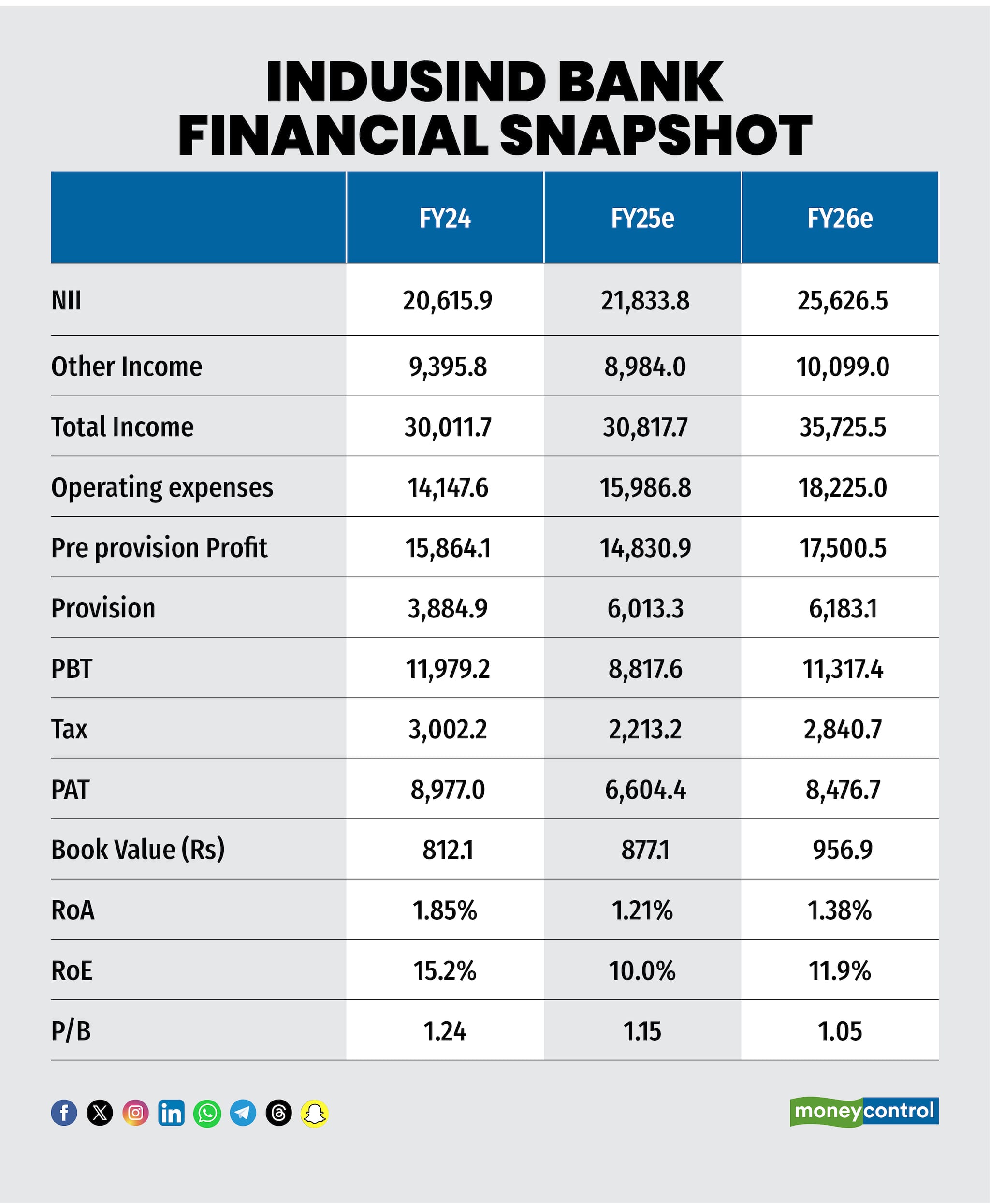

Source: CompanySlippage remains elevatedThe overall slippage to NPAs remains elevated and were sequentially higher. In addition to retail – mostly from the vehicle book and micro-finance; there was a slippage from the corporate book of Rs 281 crore, mainly contributed by one restructured real estate account. Thanks to the higher write-off of Rs 984 crore, the gross and net NPA stood at 2.25 percent and 0.68 percent respectively with a provision cover of 70 percent. Source: CompanyWhile slippage may remain elevated in Q4 on the back of micro-finance stress, there are some emerging green shoots. The 30-90 Day Past Due (DPD) book in micro-finance was stable at 4 percent against 4.1 percent in the previous quarter. The incremental stress in micro-finance seems to be peaking out as seen in reducing forward flows from 0-DPD customers. With stricter rules in place and a gradual reduction in the over-leverage situation, an improvement is likely from FY26. The overall Special mention accounts (overdue 30 to 90 days) is now 20 basis points of assets compared to 33 basis points in the previous quarter, indicating lower stress formation.The quarter also saw subdued performance on core fees, reflecting lower retail disbursements in a few pockets although overall the bank has kept a tight leash on costs.While the RoA has dropped to little over 1 percent, so has been the contraction in the valuation multiple. We see the bank limping back to normalcy a few quarters down the line. Aggressive long-term investors should start adding the stock.

Source: CompanyWhile slippage may remain elevated in Q4 on the back of micro-finance stress, there are some emerging green shoots. The 30-90 Day Past Due (DPD) book in micro-finance was stable at 4 percent against 4.1 percent in the previous quarter. The incremental stress in micro-finance seems to be peaking out as seen in reducing forward flows from 0-DPD customers. With stricter rules in place and a gradual reduction in the over-leverage situation, an improvement is likely from FY26. The overall Special mention accounts (overdue 30 to 90 days) is now 20 basis points of assets compared to 33 basis points in the previous quarter, indicating lower stress formation.The quarter also saw subdued performance on core fees, reflecting lower retail disbursements in a few pockets although overall the bank has kept a tight leash on costs.While the RoA has dropped to little over 1 percent, so has been the contraction in the valuation multiple. We see the bank limping back to normalcy a few quarters down the line. Aggressive long-term investors should start adding the stock. Source: Company, Moneycontrol Research Key risks: Severe macro slowdown impacting growth and asset quality

Source: Company, Moneycontrol Research Key risks: Severe macro slowdown impacting growth and asset quality

No comments:

Post a Comment