The penalty follows an inspection conducted by SEBI between February 2021 and September 2022. In its detailed 45-page order, SEBI found that BSE's system architecture allowed its paid clients and internal listing compliance monitoring team to access corporate announcements before they were made public on its website, violating regulatory norms.

SEBI also noted that BSE's data dissemination process lacked necessary safeguards to ensure simultaneous and equal access to information for all stakeholders. This deficiency is critical as it undermines market integrity and can lead to unfair information advantages.

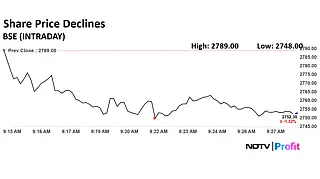

The scrip fell as much as 1.47% to Rs 2,748 apiece. It pared losses to trade 0.95% lower at Rs 2,762 apiece, as of 09:25 a.m. This compares to a 0.35% advance in the NSE Nifty 50.

source: NDTV Profit

It has risen 226.15% in the last 12 months. Total traded volume so far in the day stood at 0.07 times its 30-day average. The relative strength index was at 57.

Out of 14 analysts tracking the company, nine maintain a 'buy' rating, four recommend a 'hold' and one suggests 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 13.6%.

No comments:

Post a Comment