HCL TECH (CMP: Rs 1,989, Market Cap: Rs 539,856 crore, Rating: Overweight) delivered an in-line performance in Q3 FY25. While revenues were in line, margins showed strength. The company upped its full-year guidance, although the same was largely on account of an acquisition. What clearly stole the show was the commentary on demand and discretionary spending although Q4 is expected to be a tad soft. While the stock has outperformed the Nifty by a huge margin in the past year and has been a winning idea within the IT pack, the current volatility presents an opportunity to add the stock to ride the technology up-cycle.

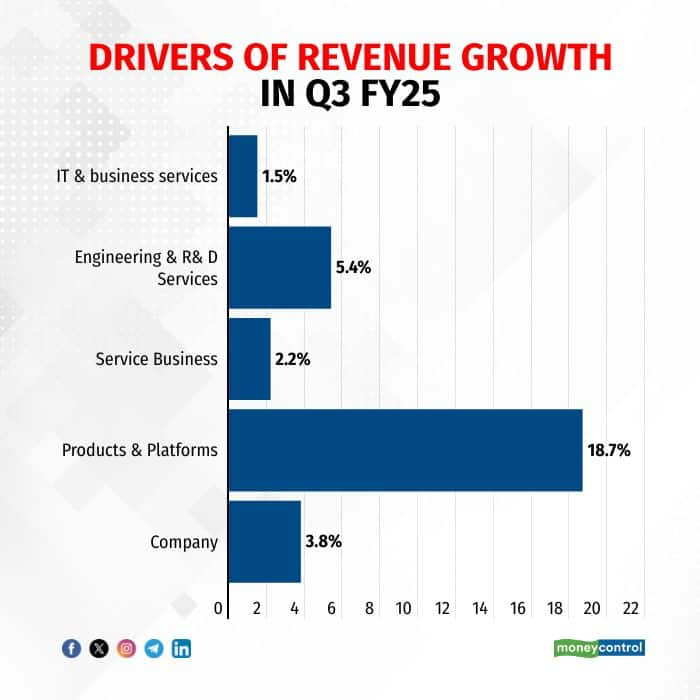

In line Q3 FY25 Source: CompanyRevenue – steady showHCL Tech reported a sequential Constant Currency (CC) revenue growth of 3.8 percent, thanks to the strong seasonality from HCL Software during the quarter. The service revenue growth of 2.2 percent sequentially was driven by Engineering R&D.

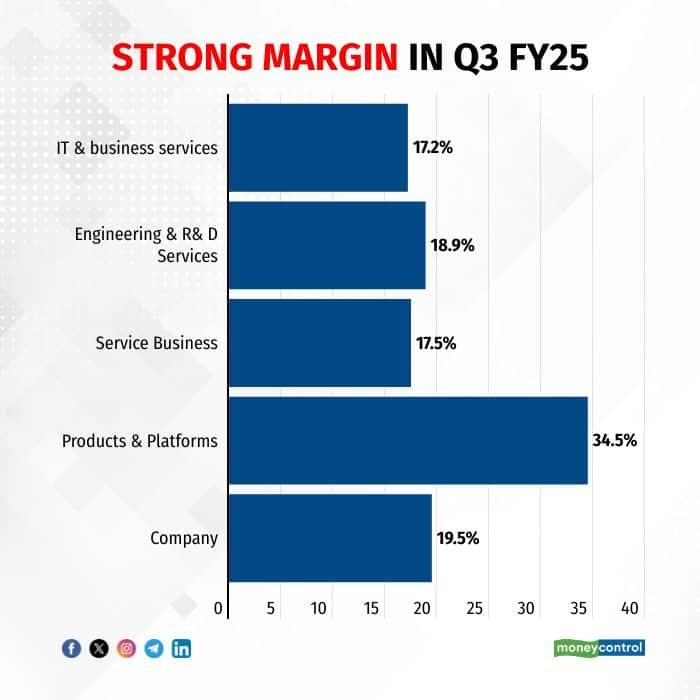

Source: CompanyRevenue – steady showHCL Tech reported a sequential Constant Currency (CC) revenue growth of 3.8 percent, thanks to the strong seasonality from HCL Software during the quarter. The service revenue growth of 2.2 percent sequentially was driven by Engineering R&D. Source: CompanyThe key markets of Americas and Europe delivered strong growth. In terms of industry verticals, financial services, technology, retail CPG, and telecom media showed good growth. Out of its seven industry verticals, except for life sciences, healthcare and public services, others are showing signs of improving demand. HCL Software contracted by over 2 percent YoY as some renewals and deal closures did not happen in the quarter.The company has upped the full-year revenue guidance in Constant Currency from 3.5-5 percent to 4.5-5 percent. Around 50 basis points of the addition is attributed to the acquisition of Communication Technology Group from Hewlett Packard.The guidance implies Q4 organic service revenue growth of minus 1.3 percent to 0.6 percent. The softness despite the absence of furloughs is due to the completion of a large project in retail in Q3 and a mega telecom deal ramp-down in Q4.Margin – surprised positivelyThe performance on the margin front was a clear positive surprise with a sequential uptick of 93 basis points, thanks to HCL Products recording its highest-ever EBIT margin. While a sequential contribution of 114 basis points to margin came from software, there was a drag of 22 basis points in services. Thanks to efficiency gains from Project Ascend and forex impact, HCL was able to offset the drag from wage hike, furloughs, and acquisition cost. We feel growth remains a key lever for margin improvement going forward, although the company has guided margin in the band of 18-19 percent for FY25.

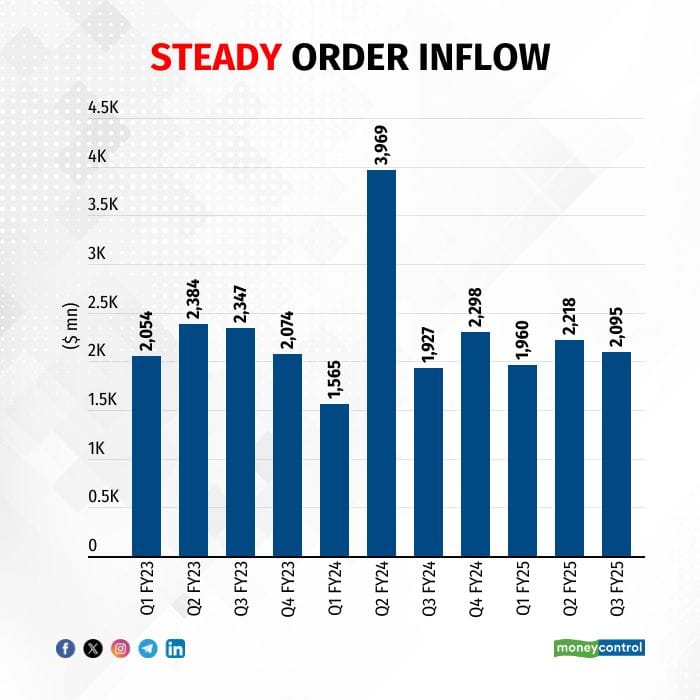

Source: CompanyThe key markets of Americas and Europe delivered strong growth. In terms of industry verticals, financial services, technology, retail CPG, and telecom media showed good growth. Out of its seven industry verticals, except for life sciences, healthcare and public services, others are showing signs of improving demand. HCL Software contracted by over 2 percent YoY as some renewals and deal closures did not happen in the quarter.The company has upped the full-year revenue guidance in Constant Currency from 3.5-5 percent to 4.5-5 percent. Around 50 basis points of the addition is attributed to the acquisition of Communication Technology Group from Hewlett Packard.The guidance implies Q4 organic service revenue growth of minus 1.3 percent to 0.6 percent. The softness despite the absence of furloughs is due to the completion of a large project in retail in Q3 and a mega telecom deal ramp-down in Q4.Margin – surprised positivelyThe performance on the margin front was a clear positive surprise with a sequential uptick of 93 basis points, thanks to HCL Products recording its highest-ever EBIT margin. While a sequential contribution of 114 basis points to margin came from software, there was a drag of 22 basis points in services. Thanks to efficiency gains from Project Ascend and forex impact, HCL was able to offset the drag from wage hike, furloughs, and acquisition cost. We feel growth remains a key lever for margin improvement going forward, although the company has guided margin in the band of 18-19 percent for FY25. Source: CompanySteady inflows and robust pipelineOrder inflows were steady with the company bagging 12 deals – 7 in services and the rest in software. The demand environment is steadily improving and short-cycle orders are coming back. Hence, the company's ACV (annual contract value) is showing strength – up 23 percent YoY and 9 percent sequentially, which should support revenue.

Source: CompanySteady inflows and robust pipelineOrder inflows were steady with the company bagging 12 deals – 7 in services and the rest in software. The demand environment is steadily improving and short-cycle orders are coming back. Hence, the company's ACV (annual contract value) is showing strength – up 23 percent YoY and 9 percent sequentially, which should support revenue. Source: CompanyThe management alluded to an all-time high deal pipeline and expects good bookings in the coming quarters. It has done an excellent job in client mining and has gained out of vendor consolidation. The performance of the top accounts has been much ahead of the company average.

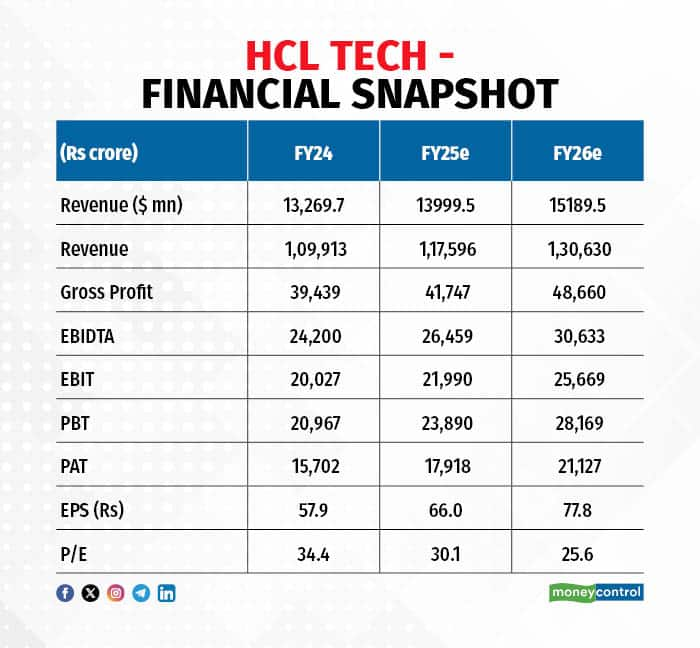

Source: CompanyThe management alluded to an all-time high deal pipeline and expects good bookings in the coming quarters. It has done an excellent job in client mining and has gained out of vendor consolidation. The performance of the top accounts has been much ahead of the company average. Source: CompanyThe net addition to people as well as hiring of freshers were positive. The attrition rate inched up a bit, thanks to the gradually improving demand.The strength in the outlookThe management's commentary was laced with optimism and confidence on demand gaining strength, discretionary spending reviving, shorter deals making a comeback, and decision-making cycle shortening. HCL Tech expects companies to increase their IT spending budgets in 2025 and Gen AI is becoming more real than ever before in almost every deal.Despite its outperformance, the current volatility is a good time to add the stock to ride the demand revival. The stock has reacted negatively to soft Q4 and miss on HCL Software and this opens up an opportunity to accumulate.

Source: CompanyThe net addition to people as well as hiring of freshers were positive. The attrition rate inched up a bit, thanks to the gradually improving demand.The strength in the outlookThe management's commentary was laced with optimism and confidence on demand gaining strength, discretionary spending reviving, shorter deals making a comeback, and decision-making cycle shortening. HCL Tech expects companies to increase their IT spending budgets in 2025 and Gen AI is becoming more real than ever before in almost every deal.Despite its outperformance, the current volatility is a good time to add the stock to ride the demand revival. The stock has reacted negatively to soft Q4 and miss on HCL Software and this opens up an opportunity to accumulate. Source: Company, Moneycontrol ResearchKey risks: Severe curtailment in IT spending due to macro slowdown in developed countries

Source: Company, Moneycontrol ResearchKey risks: Severe curtailment in IT spending due to macro slowdown in developed countriesResearch Report by Madhuchala, Network 18

No comments:

Post a Comment